The DJIA turned decisively higher after the FOMC statement

The Dow Jones Industrial Average (DJIA) explored both sides of breakeven today, but took a decisive turn higher after the Federal Open Market Committee's (FOMC) highly anticipated policy statement. The central bank opted to leave rates at record lows, but suggested it's on track to hike the benchmark as early as September, assuming the economic backdrop is conducive -- and some officials are now anticipating two hikes by the end of 2015, according to the latest projections.

Continue reading for more on today's market, including:

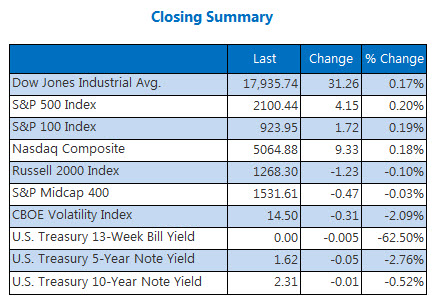

The Dow Jones Industrial Average (DJIA - 17,935.74) explored a range of more than 158 points -- and was within 2 points of 18,000 at its session peak -- before ending on a gain of 31.3 points, or 0.2%. Twenty-two of the Dow's 30 components ended higher, led by 1.2% gains for American Express Company (NYSE:AXP) and Procter & Gamble Co (NYSE:PG). UnitedHealth Group Inc. (NYSE:UNH) paced the black sheep with a loss of 1.5%.

The S&P 500 Index (SPX - 2,100.44) also endured a wishy-washy session, but resolved to the upside, advancing 4.2 points, or 0.2%, and edging back atop the 2,100 level. Like its peers, the Nasdaq Composite (COMP - 5,064.88) spent some pre-Fed time in the red, but gained 9.3 points, or 0.2%, by the bell.

The CBOE Volatility Index (VIX - 14.50) struggled for direction, but turned lower after the Fed statement. By the close, the "fear gauge" was down 0.3 point, or 2.1%.

Sign up now to get Schaeffer's Opening View delivered straight to your inbox!

5 Items on Our Radar Today:

- After a ho-hum winter, the U.S. economy is growing modestly, according to the Fed. The central bank cut its 2015 growth projections to a range of 1.8% to 2%, down from a range of 2.3% to 2.7% forecast in March. (Reuters)

- In her post-meeting press conference, Fed Chair Janet Yellen talked rate-hike timing, and warned that failing to resolve Greece's financial crisis could cause disruptions in U.S. markets. Meanwhile, Jeroen Dijsselbloem, president of the eurozone finance meetings, pegged the odds of a breakthrough at tomorrow's key meeting at "very small." (CNBC; AP, via U.S. News)

- While KR speculators are betting on the company to snap its streak of positive earnings reactions, RAD traders are pricing in another dramatic move.

- Piper Jaffray waxed optimistic on Eli Lilly and Co (NYSE:LLY). Merck & Co., Inc. (NYSE:MRK)? Not so much.

- In the wake of a management shift, this media giant was the target of a seven-figure bet.

Commodities:

Oil started the session higher, but fizzled after an unexpected rise in both domestic gasoline inventories and Cushing, Oklahoma-based crude stockpiles. However, the dollar softened after the Fed announcement, helping black gold trim its loss to 5 cents, or just 0.1%, and close at $59.92 per barrel.

Gold futures ended on a loss of $4.10, or 0.4%, at $1,176.80 an ounce. In the wake of the Fed decision, however, the malleable metal has turned higher in electronic trading.