An upbeat durable goods orders report is helping DJIA futures cling to gains

Despite a sell-off in Chinese stocks, Dow Jones Industrial Average (DJIA) futures are modestly north of fair value in pre-market trading, as oil prices continue to stabilize and traders digest dovish remarks from St. Louis Fed President James Bullard. Specifically, April-dated crude futures are off just 0.7% at $31.93 per barrel, while Bullard last night said he opposes additional interest-rate hikes, considering current inflation expectations. Meanwhile, jobless claims rose slightly more than expected last week, and January durable goods orders rebounded strongly after the prior month's decline.

Continue reading for more on today's market, including:

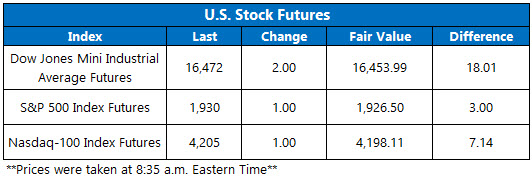

Futures on the Dow Jones Industrial Average (DJIA) are roughly 18 points above fair value.

5 Things You Need to Know Today

- Liquidity concerns took a major toll on Chinese stocks, just in time for the Group of 20 (G-20) meeting in Shanghai.

- The Chicago Board Options Exchange (CBOE) saw 754,038 call contracts traded on Wednesday, compared to 533,065 put contracts. The resultant single-session equity put/call ratio held steady at 0.71, while the 21-day moving average edged up to 0.75.

- Best Buy Co Inc (NYSE:BBY) is staring at a 3% pre-market loss, with the electronics retailer's disappointing current-quarter forecast overshadowing an earnings beat. The stock closed at $31.47 yesterday, while in the options pits bearish bets have been mounting.

- Roughly two weeks after disclosing a stake in Square Inc (NYSE:SQ), Visa Inc (NYSE:V) announced a payment-security agreement with China UnionPay. After closing at $71.85 on Wednesday, V is pointed 0.3% higher ahead of the bell.

- Retailer Sears Holdings Corp (NASDAQ:SHLD) posted a $580 million net loss last quarter -- far wider than its prior-year loss of $159 million, but in line with the estimate from its shareholder update earlier this month. Nonetheless, the stock is aimed 4.3% higher in electronic trading, after finishing at $16.97 yesterday.

Earnings and Economic Data

Atlanta Fed President Dennis Lockhart will speak before the open, followed by San Francisco Fed President John Williams at 12 p.m. ET. On the earnings front, Baidu (BIDU), Herbalife (HLF), AMC Networks (AMCX), Anheuser-Busch InBev (BUD), Autodesk (ADSK), Biomarin Pharmaceuticals (BMRN), Chico's FAS (CHS), Domino's Pizza (DPZ), Gap (GPS), Gogo (GOGO), Intuit (INTU), Kohl's (KSS), Kraft Heinz (KHC), NutriSystem (NTRI), Palo Alto Networks (PANW), Seadrill Ltd (SDRL), Splunk (SPLK), and Weight Watchers International (WTW) will report. To see what else is coming up on this week's agenda, click here.