DJIA futures are getting a lift from gains in European stocks

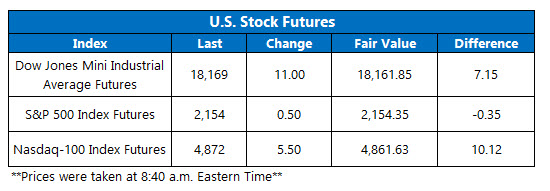

Dow Jones Industrial Average (DJIA) futures are trading just north of fair value, as U.S. stocks look to follow their overseas peers higher. Specifically, stocks in Europe are gaining in light of a huge drop in the pound and a solid start for

embattled lender Deutsche Bank AG (USA) (NYSE:DB). Back at home, the economic calendar is rather bare after Monday's

data dump pressured the Dow lower, though traders are digesting a "strong case ... for raising our interest rate" from Richmond Fed President Jeffrey Lacker, as well as a downwardly revised North American growth forecast from the International Monetary Fund (IMF).

Continue reading for more on today's market, including:

Futures on the Dow Jones Industrial Average (DJIA) are 7.2 points above fair value.

5 Things You Need to Know Today

- The latest "Brexit" talk has the pound at its lowest level against the dollar in 30 years.

- The Chicago Board Options Exchange (CBOE) saw 518,965 call contracts traded on Monday, compared to 332,215 put contracts. The resultant single-session equity put/call ratio rose to 0.64, while the 21-day moving average edged up to 0.65.

- Alphabet Inc (NASDAQ:GOOGL) is expected to announce a number of new products at an event today, including new smartphones to challenge Apple Inc. (NASDAQ:AAPL) and a voice-activated device similar to Amazon.com, Inc.'s (NASDAQ:AMZN) Echo. Shares of GOOGL have had a tremendous year, touching a series of all-time highs throughout September, and were last seen at $800.38.

- Cloud computing expert salesforce.com, inc. (NYSE:CRM) is again making waves on the M&A front, with the company announcing the purchase of marketing specialist Krux. The cash-and-stock deal is valued at $700 million, and CRM is edging higher in pre-market trading following the news. However, at $70.52, the stock remains 10% lower year-to-date.

- Casino stock Las Vegas Sands Corp. (NYSE:LVS) is also moving higher ahead of the open, adding close to 2% as casinos continue to celebrate solid data out of Macau. LVS -- like this sector peer -- has had a big year, picking up more than 34%, with Monday's close of $58.87 marking its best finish since April 2015.

Earnings and Economic Data

There are no economic reports slated for release, but Chicago Fed President Charles Evans set to talk after the close. Darden Restaurants (DRI) and Micron Technology (MU) will step up to the earnings plate. To see what else is coming up on this week's schedule, click here.

Don't miss the market's next move! Sign up now for Schaeffer's Midday Market Check