The DJIA's losing streak marks the longest since August 2011

The Dow Jones Industrial Average (DJIA) was down nearly 184 points at its intraday low, and despite paring those losses considerably, still finished in the red for an eighth straight trading day -- its longest losing streak since August 2011. President Donald Trump's legislative disaster from Friday was the main negative catalyst once again, with telecom and financial stocks bearing the brunt of the selling pressure. However, the S&P 500 Index (SPX) briefly turned positive in late-day trading, and the tech-heavy Nasdaq Composite (COMP) hung on for a modest advance.

Continue reading for more on today's market, including:

- What the Dow losing streak could mean for stocks.

- Options traders are keeping the faith in these 2 hard-hit bank stocks.

- 10 top stocks for April, courtesy of our founder and CEO Bernie Schaeffer.

- Plus, the retail trade that didn't happen; a second look at Cree stock; and 2 ways to play gold.

The Dow Jones Industrial Average (DJIA - 20,550.98) landed 45.7 points, or 0.2%, lower. Half of the 30 Dow stocks advanced, with DuPont up 1.2% to lead the way. Conversely, Chevron shares paced the 15 blue-chip losers, giving back 1.6%.

The S&P 500 Index (SPX - 2,341.59) dipped 2.4 points, or 0.1%. Avoiding a loss, the Nasdaq Composite (COMP - 5,840.37) tacked on 11.6 points, or 0.2%.

The CBOE Volatility Index (VIX - 12.50) surrendered 0.5 point, or 3.5%, after hitting a four-month intraday high of 15.11.

5 Items on Our Radar Today

-

Wells Fargo has rolled out

ATMs that can be used without a bank card, allowing customers to access cash with just their smartphones and an app.

(The Washington Post)

-

The European Union (EU) gave Dow Chemical and DuPont a green light on their $130 billion

merger, after the companies agreed to unload assets. That said, the deal still needs approval from regulators in the U.S. and several other nations.

(Reuters)

- Schaeffer's Senior V.P. of Research Todd Salamone explains why he sidestepped a Dollar Tree options trade.

- Option bulls may want to give Cree stock a second look.

- 2 gold stocks to play without breaking the bank.

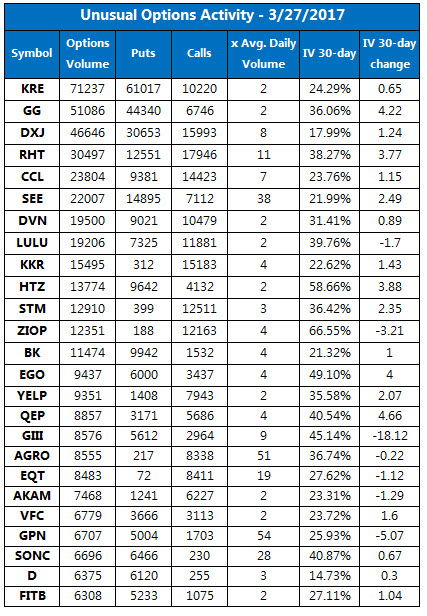

Data courtesy of Trade-Alert

Commodities

Oil struggled again, after major crude exporters over the weekend agreed only to review extending output cuts, rather than actually prolonging them. May-dated crude futures shed 24 cents, or 0.5%, to close at $47.73 per barrel.

Gold gained some positive momentum as President Trump's healthcare failure weighed on stocks and the dollar. Gold for April delivery added $7.20, or 0.6%, to land at $1,255.70 per ounce -- the malleable metal's highest settlement since Feb. 27.

Get your daily dose of Dow futures, stock news, and more with Schaeffer's Opening View.