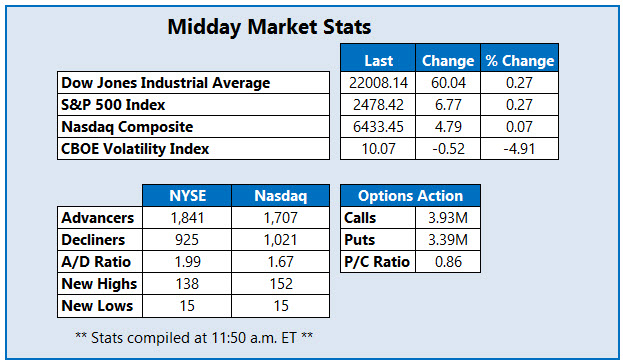

The S&P is pacing for a sixth straight daily win - its longest winning streak since May

The Dow Jones Industrial Average (DJIA) is higher at midday, climbing past the 22,000 level for the first time in two weeks, despite subpar jobs data. The weaker-than-expected nonfarm payrolls report, combined with yesterday's tame inflation data, have curbed expectations for a Fed rate hike in December. The S&P 500 Index (SPX) and Nasdaq Composite (COMP) are also higher at midday, with the former pacing for a sixth straight daily win -- its best stretch since May. All three indexes are on track to close the week higher. The CBOE Volatility Index (VIX) continues to drop, and is now on track for its third straight weekly loss.

Continue reading for more on today's market -- and don't miss:

- The drug stock up 60%.

- The cloud stock that could be ripe for a short squeeze.

- Plus, CAR options volume pops ahead of a key House vote; FCAU sets a new record; and Kroger stock attempts a comeback.

Among the stocks with unusual options volume iscar rental service

Avis Budget Group Inc. (NASDAQ:CAR), with over 2,700 calls traded -- four times the average intraday pace, and on track for 98th percentile in its annual range. Meanwhile, roughly 3,900 puts have changed hands -- twice the intraday norm. The October 37 put has attracted notable attention, with over 2,000 contracts traded. CAR

stock is currently down 1% to trade at $35.93, after earlier touching a six-month high of $37.68, as the House of Representatives prepares to vote on self-driving car legislation next week. Avis Budget recently partnered with Alphabet's self-driving car unit,

Waymo.

Fiat Chrysler Automobiles NV (NYSE:FCAU) is up 4.7% at $15.84, and just notched a new record high of $16.03, with the shares near the top of the New York Stock Exchange (NYSE) today. Standard & Poor's (S&P) revised its outlook on the Jeep parent to "positive" from "stable," even after Fiat Chrysler said U.S. vehicle sales fell 11% in August. FCAU stock has added 133% year-over-year, and Goldman Sachs believes the shares could soar much higher.

Grocery name

Kroger Co (NYSE:KR) is among the best stocks on the S&P 500 today, up 2.7% to trade at $22.46. The stock has struggling to compete with rival

Whole Foods, which is now owned by Amazon, and the company is slated to report earnings one week from today. Following back-to-back bear gaps in June, KR stock has now shed 35% year-to-date, and its 50-day moving average has contained recent rebound attempts.