Anticipation over the Shenzhen-Hong Kong stock connect, as well as mounting stimulus expectations, boosted stocks in China

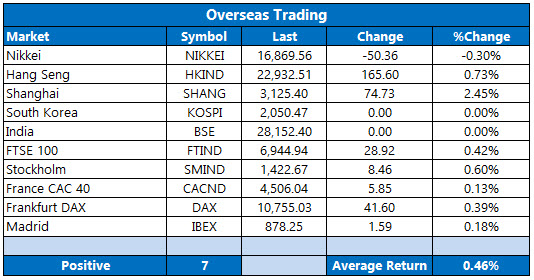

Stocks in Asia started the week off on mostly solid footing, with Chinese markets proving especially strong. Specifically, the Shanghai Composite roared to a 2.5% win, amid hopes for additional stimulus after an

ugly round of data last week and excitement over the

Shenzhen-Hong Kong exchange trading link. Expectations are growing that a timetable for the stock connect's opening could be announced as soon as this week.

Elsewhere, Hong Kong's Hang Seng tacked on 0.7%, while Japan's Nikkei sank 0.3% after second-quarter gross domestic product (GDP) data hinted at a stalling economy -- with declining exports and business investment largely to blame. South Korean markets were shuttered for the Liberation Day holiday.

In Europe, stocks are edging higher, helped by a modest rise in oil prices. London's FTSE 100 is up 0.4%, bolstered by JPMorgan Securities -- which reiterated its "overweight" rating on U.K. stocks, citing strong dividend yields and the potential for more monetary easing. Germany's DAX has also advanced 0.4%, getting a lift from Volkswagen shares. Rounding things out, France's CAC 40 has inched 0.1% higher.

Sign up now for Schaeffer's Market Recap to get all the day's big stock movers, must-know technical levels, and top economic stories straight to your inbox.