ADSK options traders have been unusually put-skewed in recent weeks

Software stock

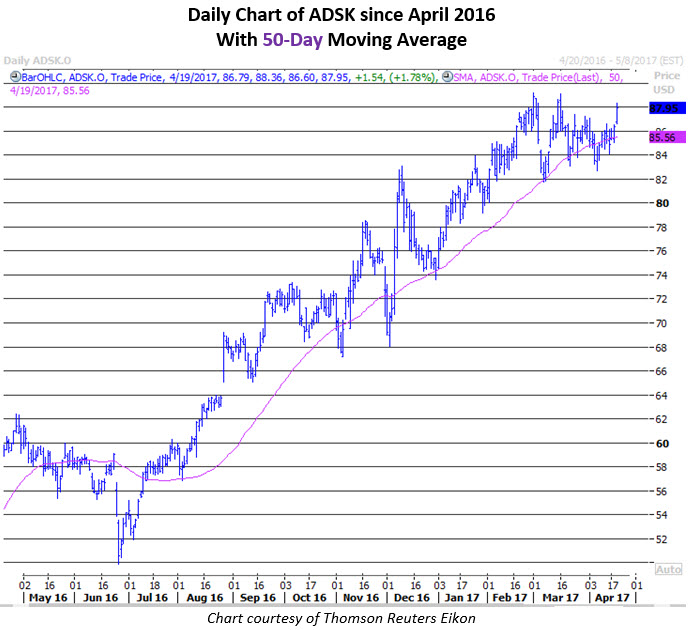

Autodesk, Inc. (NASDAQ:ADSK) is trading 2.2% higher today at $88.33, but that's nothing new. Shares of ADSK are up 49% year-over-year, and hit a record high of $89.18 on March 1. Since then, the all-important 50-day moving average has served as support. Not only that, but ADSK stock has more upside potential, from a

contrarian perspective, given the overwhelming pessimism seen on Wall Street.

Starting in the options pits, ADSK stock has a 50-day put/call volume ratio of 1.62 at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). This put-skewed ratio stands above 99% of the past year's readings, and Schaeffer's Quantitative Analyst Chris Prybal notes that such elevated readings have historically led to outsized returns.

Interestingly, the most popular put during the past two weeks, based on increases in open interest, was the May 75 strike, and data from the major exchanges confirms sell-to-open activity. This means these put traders are expecting the shares to hold above $75 in the weeks ahead. The May 80 and 82.50 puts were also popular, and buy-to-open activity has been detected at both, suggesting options traders are either betting on -- or hedging against -- a pullback in ADSK stock.

Elsewhere, short sellers continue to target Autodesk stock, despite its strong technical performance. Short interest increased by more than 12% in the last reporting period alone, and these bears now control nearly a week's worth of buying power, based on average daily volumes. As such, there's still potential for a short-squeeze situation to send

ADSK stock higher.

Not only that, but there's plenty of pessimism to be found in the analyst community, too. While nine analysts rate the shares a "strong buy," eight others give them a "hold" or worse recommendation. Plus, Autodesk, Inc. (NASDAQ:ADSK) is now trading above its average 12-month price target of $87.24. This all means ADSK stock could benefit from a round of price-target hikes and/or upgrades.