The 10-year Treasury yield hit its highest level in over a year

Stocks ended the day sharply lower, as surging bond yields stoked investor fears of equity valuations and forced them to ditch growth-focused stocks. The 10-year Treasury yield rose above 1.75% at its session peak -- its highest level since January 2020 -- while the U.S. Federal Reserve said it would allow inflation to run hotter than usual in order to ensure a smooth economic recovery.

As a result, the Dow tumbled from a new intraday record high, while the tech-laden Nasdaq took a beating and snapped its three-day win streak. Apple (AAPL), Alphabet (GOOGL), and Microsoft (MSFT) all lost at least 2%, while sector behemoth Tesla tumbled over 5%. Nevertheless, Wall Street's "fear gauge," the Cboe Volatility Index (VIX), fell to an annual low earlier today before pivoting higher at the close.

Continue reading for more on today's market, including:

- Coherent stock surged following a massive buyout bid.

- After logging a record high, what's left for DECK?

- Plus, why Nikola stock plummeted; two-year highs for SIG; and Peloton stock tripped up.

The Dow Jones Industrial Average (DJI - 32,862.30) fell 153.1 points, or 0.5% for the day. UnitedHealth (UNH) topped the list of Dow components with a 2.8% rise, while Chevron (CVX) fell 3.5% to pace the laggards.

Meanwhile, the S&P 500 Index (SPX - 3,915.46) lost 58.7 points, or 1.5% for the day. The Nasdaq Composite (IXIC - 13,116.17) shed 409 points, or 3% for the day.

Lastly, the Cboe Volatility Index (VIX - 21.58) rose 2.4 points, or 12.2% for the day.

- Retail stores are seizing the moment, and planning to open more stores than they close for the first time in years. (CNBC)

- After reports of blood clot side effects came to light, Europe's drug regulator has found AstraZeneca's Covid-19 vaccine "safe and effective." (MarketWatch)

- Nikola stock spiraled after a strategic partner cut its stake.

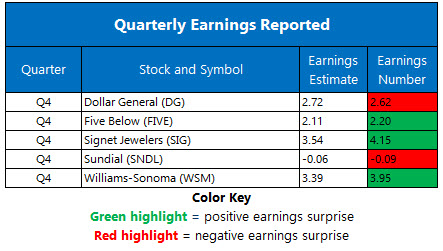

- Stellar earnings sent SIG to two-year highs.

- This stay-at-home staple fell despite seemingly upbeat news.

Oil Logs Fifth Consecutive Loss

Oil prices fell for the fifth-straight session, locking in their worst day since September. A stronger U.S. dollar, in conjunction with increased inventory and the persistence of the pandemic continue to weigh on black gold even as economic recovery efforts get underway. As a result, April-dated crude shed $4.87, or 7.5%, to settle at $59.73 per barrel.

Gold prices fell as well, as U.S. bond yields made a break higher and a firmer dollar sent investors away from the yellow metal. In response, April-dated gold shed $5.40 cents, or 0.4%, to settle at $1,732.50 an ounce.