Big Tech weakness weighed on the Nasdaq today

Fresh off its worst session in three weeks, the Dow gave back modest gains in the last minute to finish lower. "Reopening" stocks led the initial charge, though the blue-chip index and S&P 500 pivoted sharply from their session highs in late-afternoon trading, to both finish marginally in the red.

Elsewhere, the Nasdaq also logged a day in the red, as Big Tech names like Apple (AAPL) and Microsoft (MSFT) underperformed. Wall Street's "fear gauge," the Cboe Volatility Index (VIX), logged back-to-back wins for the first time since March 4, as the global tally of coronavirus cases crosses 124 million.

Continue reading for more on today's market, including:

- Signal says UnitedHealth stock has room to run.

- This restaurant stock is an intriguing contrarian pick.

- Plus, GIS' rough day; call traders play Adobe earnings; and a bank stock gets an overdue bull note.

The Dow Jones Industrial Average (DJI - 32,420.06) fell 3.1 points today. Oil-and-gas giant Chevron (CVX) topped the list of Dow components with a 2.7% rise, while Nike (NKE) fell 2.9% to pace the 15 laggards.

Meanwhile, the S&P 500 Index (SPX - 3,889.14) shed 21.4 points, or 0.6% for the day. The Nasdaq Composite (IXIC - 12,961.89) lost 265.8 points, or 2% for the day.

Lastly, the Cboe Volatility Index (VIX - 21.20) rose 0.9 point, or 4.4%, on the day.

- U.S. Secretary of State Antony Blinken is reiterating the Biden administration's pushback over Nord Stream 2 gas pipeline between Germany and Russia. (MarketWatch)

- Today is Equal Pay Day, and President Biden is hosting members of the U.S. Women’s national soccer team for a discussion about better pay for American women. (Reuters)

- See why General Mills stock ceded a key level today.

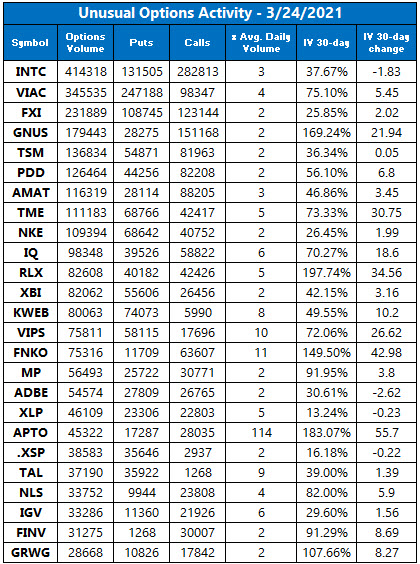

- Options bulls were unfazed by ADBE's post-earnings dip.

- A double-upgrade could be just the beginning for this bank stock.

Oil, Gold Join the Rally

Oil prices bounced back in today's trading, with black gold inching higher in response to the Suez Canal ship that has run aground, and the prospect that delayed shipments could give prices a shot in the arm. In response, May-dated crude added $3.42, or 5.9%, to settle at $61.18 per barrel.

Gold prices joined the party too, gaining despite a rising dollar and bubbling 10-year Treasury yields. April-dated gold tacked on $8.10, or 0.5%, to settle at $1,733.20 an ounce.