Both names currently have cheap short-term options, too

Oil stocks have grabbed headlines lately, amid swinging crude futures. And while this pair of blue-chip energy names are bucking historically bearish headwinds, these under-the-radar mid-cap stocks are worth keeping an eye on, too. In fact, both Oasis Petroleum Inc. (NYSE:OAS) and Nabors Industries Ltd. (NYSE:NBR) are throwing up potential "buy" signals, and have attractively priced options to boot.

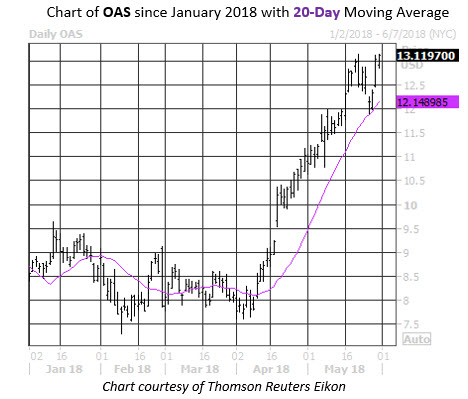

Oasis Stock Hit a New High Earlier

Oasis Petroleum stock has been a steady climber since April, adding 60% so far this quarter and guided higher by its 20-day moving average. The stock hit an annual high of $13.39 earlier, but was last seen down 0.2% to trade at $13.02.

What's more, OAS' Schaeffer's Volatility Index (SVI) is docked at 52.6% -- in the 7th annual percentile, meaning premium on short-term contracts is relatively cheap at the moment, from a volatility perspective. According to Schaeffer's Senior Quantitative Analyst Rocky White, the one other time OAS has been trading near 52-week highs with its SVI ranked in the lower fifth of its annual range since 2008, the stock was up 23.71% one month later. Another rally of this magnitude would put Oasis shares back above $16 for the first time since January 2017.

Nabors Stock Pulls Back to Key Technical Trendline

Looking at Nabors Industries, the equity has been chopping higher since its mid-February lows, topping out at an 11-month peak of $8.87 on May 17. Since then, the oil stock has pulled back to its 80-day moving average. However, this could have bullish implications for the security based on previous signals.

In fact, over the past three years, there have been four occasions where NBR has come within one standard deviation of its 80-day moving average after an extended stint above this trendline, according to White. One month later, the security averaged a return of 8.87%.

Those wanting to bet on more upside for the oil stock can pick up near-term options at a relative bargain. The equity's SVI of 50% ranks in the 13th percentile of its annual range, indicating premium on short-term contracts is pricing in low volatility expectations at the moment.