WWE is among the stocks that tend to exceed volatility expectations

Earnings season is heating up, with big banks in focus this morning. With that in mind, we decided to hunt for some options-trading ideas for premium buyers this earnings season. Specifically, we identified stocks that have tended to make outsized moves on the charts in the past year, relative to what the options market has priced in, then singled out companies with earnings expected in the next couple of weeks. On the list: World Wrestling Entertainment, Inc. (NYSE:WWE) stock -- which is popping today on upbeat analyst attention.

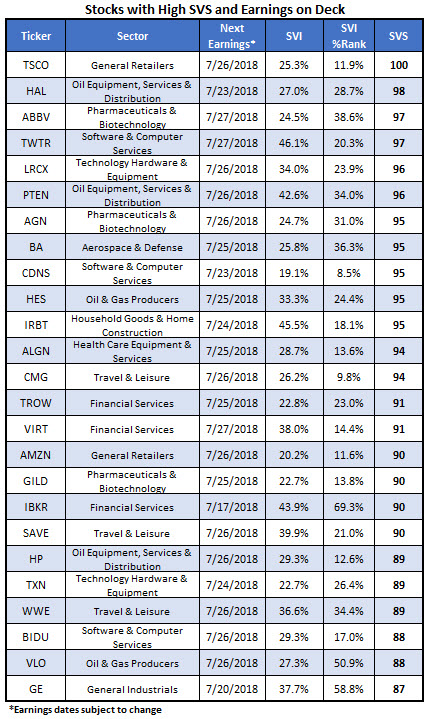

Stocks That Tend to Exceed Volatility Expectations

Below is a list of 25 stocks that trade at least a million shares per day and have closed at $7 or more. These stocks have high Schaeffer's Volatility Scorecard (SVS) readings, meaning they have tended to exceed options traders' volatility expectations in the past year -- a boon for would-be premium buyers. Additionally, stocks with a low Schaeffer's Volatility Index (SVI) percentile rank have near-term options that are pricing in relatively low volatility expectations at the moment. All of the companies listed below are expected to report earnings before August (but please check with each company's respective website for official reporting dates).

WWE Stock Hits New High

World Wrestling Entertainment stock is up 4.4% to trade at $77.85 this morning, after Morgan Stanley hiked its price target by $42 to $100 -- implying expected upside of 34% to the security's close on Thursday. The analyst said WWE content is "the undisputed champion," and called it "likely the fastest growing earnings story in our coverage group." As such, WWE stock is just off a fresh record high of $79.95, and is up more than 275% year-over-year.

The company is expected to report earnings on Thursday, July 26. As you can see on the chart above, WWE sports an SVS of 89 out of a possible 100. This suggests the shares have had no problems making big moves on the charts, compared to what the options market has priced in.

The stock popped 4% higher the day of its last earnings release, and has moved higher after three of the last four quarterly earnings reports. Another well-received earnings report later this month could spook some lingering short sellers. Despite WWE stock's impressive rise on the charts, short interest represents more than 18% of the equity's total available float, or about a week's worth of pent-up buying demand, at the stock's average pace of trading. That's plenty of fuel for a potential short squeeze.