How Black Friday has been a signal for stocks in the past 30 years

Thanksgiving is upon us tomorrow, followed by one of the busiest shopping days of the year. Black Friday, evidently, isn't necessarily the busiest shopping day of the year as retailers run deals earlier and online shopping has become more popular. It still marks the unofficial beginning of holiday shopping. Next week, reports of Black Friday sales, foot traffic, and fist fights will come out and these reports (aside from the fist fights) will be used to gauge the strength of the consumer and the economy in general. In other words, next week is a potential catalyst for stocks in either direction. Below, I look at the week after Black Friday, how stocks have done that week, and what it has meant going forward.

Data For the Week After Black Friday

The table below shows us how next week, the week after Black Friday, has typically performed since 1990. The week has been bullish, averaging a gain of 0.68%, compared to a 0.17% gain for any week since then. Also, the percentage of returns that have been positive is higher than typical weeks (66% vs. 57%). I thought you might see a higher standard deviation during the week because of reactions to the retail shopping data and anecdotes, but that is not the case.

I also broke down the data by day of the week. Based on this, it's not prudent to buy stocks at the end of the week because the Monday after Black Friday has been a bad day for stocks. Next Monday has averaged a loss of 0.26% for the S&P 500 Index (SPX) since 1990 with only about 40% of the returns positive. In fact, 12 of the last 15 years, the Monday after Black Friday has been negative. The only day that has been especially bullish has been Friday of next week, which averages a gain of 0.61%, with nearly 80% of the returns positive.

Black Friday Reaction Indicator

I mentioned how Black Friday will be used to gauge the economy, so I thought maybe investors can use the stock market reaction to Black Friday as an indicator going forward. The table below shows how the next three months have played out since 1990 depending on whether next week has been positive or negative. When the week after Black Friday has been positive, the S&P 500 has averaged a 3.54% return over the next three months with 79% of the returns positive. When the week has been negative, however, the next three months has had an average loss of over 1%, with 60% of the returns positive. This supports the theory that next week's return works as an indicator.

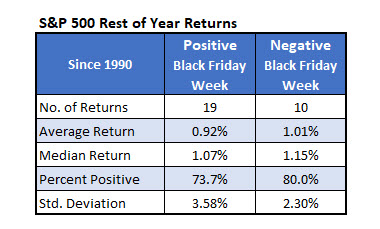

Looking at a shorter term, however, the indicator hasn't worked as well. The table below shows the same data for the rest of the year. Over this shorter time frame, the S&P 500 has done slightly better when next week has been negative.

Notable Stocks Next Week

In case anyone's curious, below are how some S&P 500 stocks from our "General Retailers" sector have performed. The stocks at the top of the list have been the most bullish while those at the bottom have been the most bearish (sorted by percent positive then by average return).

Finally, here's another list of stocks. These stocks aren't in our "General Retailers" sector but I think they're still interesting stocks around the holidays. It's notable that FedEx (FDX) and UPS (UPS) are right at the top given the prominence of online shopping nowadays.