Carnival stock sank to multi-year lows this past October

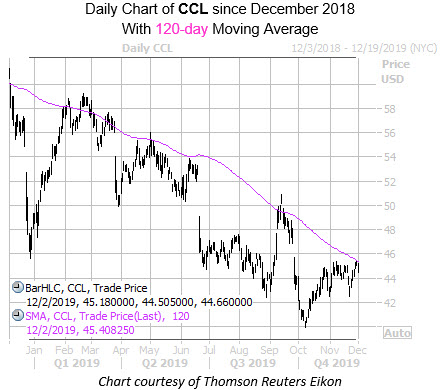

Cruise line Carnival Corp (NYSE:CCL) is down 0.9% at $44.68 in this afternoon's trading, continuing its wildly disappointing year on the charts. The stock has shed 25% over the past 12 months, and is now seeing a re-emergence of pressure from a key descending -- and historically bearish -- trendline.

According to Schaeffer's Senior Quantitative Analyst Rocky White, CCL is trading within one standard deviation of its 120-day moving average, after spending most of its time below this trendline in recent years. Similar tests of this trendline resistance have occurred eight other times over the past three years, resulting in an average 15-day loss of 5.9%, with 75% of the returns negative. Another loss of this severity would send Carnival stock down to the $42 mark -- back near the site of its five-year lows from early October -- before the end of January.

Moving into the options pits, it looks like call traders may have maxed out their bullish bets. The equity's 10-day call/put volume ratio of 6.22 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) ranks in the 100th annual percentile, meaning calls have been purchased over puts at a faster-than-usual clip during the past two weeks.