A historically bullish signal could help the security beat its latest peak

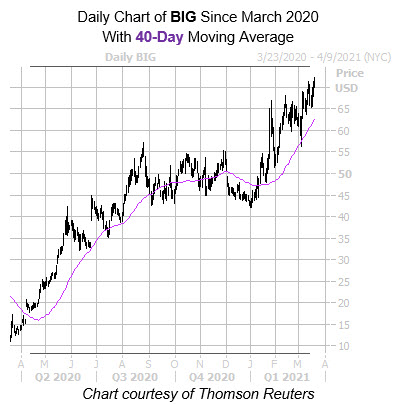

The shares of retail concern Big Lots, Inc. (NYSE: BIG) are up 1.6% at $71.82 at last check, after earlier hitting an all-time high of $72.27. The equity sports an impressive 492.5% year-over-year lead, with support from the 40-day moving average. The even better news is that BIG looks like it has room to run, per a historically bullish signal which could catapult the stock to even more records in the coming weeks.

Specifically, Big Lots stock's peak comes amid historically low implied volatility (IV), which has been a bullish combination for the equity in the past. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, there have been two other times in the past five years when the security was trading within 2% of its 52-week high, while its Schaeffer's Volatility Index (SVI) sat in the 20th percentile of its annual range or lower. This is currently the case with the equity's SVI of 52%, which stands at the second percentile of its 12-month range.

White's data shows that a month after these signals, BIG was higher, averaging a 10.7% return for that time period. From its current perch, a similar move would put the security at the $79.50 mark, a brand new all-time high.

Analysts are still pessimistic towards Big Lots stock, leaving ample room for price-target hikes and/or upgrades going forward. Of the eight analysts in question, six call it a tepid "hold" or worse rating. Plus, the 12-month consensus target price of $60.50 is a 15.8% discount to current levels.

And though shorts are hitting the exits in droves, there is plenty of pessimism left to be unwound, which could push shares even higher. Short interest fell 30.2% in the last two reporting periods, yet the 4.51 million shares sold short still make up a significant 12.4% of the stock's available float.

A shift in the options pits could create tailwinds for the security, too. This is per BIG's Schaeffer's put/call open interest ratio (SOIR) of 1.34, which sits in the top percentile of its annual range. In other words, short-term options traders have rarely been more put-biased.

This looks like an opportune time to get in on BIG with options. The equity's Schaeffer's Volatility Scorecard (SVS) sits at a high 91 out of 100, suggesting that BIG has exceeded volatility expectations during the past year.