Last week, I was a presenter at a virtual small-cap conference hosted by Benzinga. The focus of my presentation was opportunities in small caps based on technical and sentiment analysis of the Russell 2000 Index (RUT - 2,221.48) and iShares Russell 2000 ETF (IWM - 220.61). Much of what I presented revisited concepts you have likely seen in this weekly commentary since December.

Specifically, I discussed that on the heels of the RUT breakout above its 2018 peak late last year, small caps represented the biggest area of opportunity for investors, because total short interest on Russell 2000 component stocks was (and remains) historically high. In comparison, total short interest on components of the S&P 500 Index (SPX - 3,974.54) and Nasdaq-100 Index (NDX - 12,979.11) were at historically low levels, leaving less room for short-covering rallies among larger-cap names.

At the same time, I mentioned that small-caps were vulnerable to a short-term pullback, due to small-cap equity option buyers coming off an extreme in optimism that usually occurs ahead of weakness. Moreover, I displayed these two graphs that captured the IWM and RUT showing vulnerability to a short-term setback. My two technical concerns were:

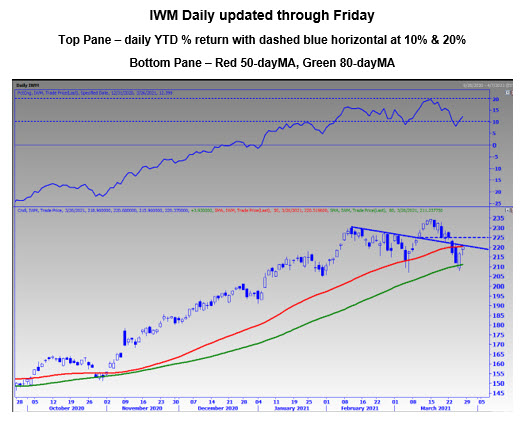

- The IWM recently peaking near the $235 level, which corresponds to a round 20% year-to-date gain for the ETF, along with its 50-day and 80-day moving averages as potential support zones.

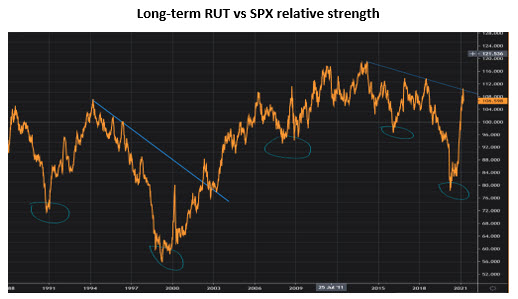

- A long-term relative strength chart of the RUT vs SPX bumping up against a trendline marking lower highs since 2014.

These graphs are displayed immediately below.

My takeaways from these graphs were as follows:

- If short-term weakness continued, I could see the IWM pulling back to the $210 area, which was the site of its 80-day moving average. My thought was a move below the popular 50-day moving average at $220 could flush out weaker hands. Plus, the 80-day moving average, which marked closing lows in late-October/early-November, was in the vicinity of the level that corresponds to 10% above the 2020 close, and 10% below the March 15 closing high. A 10% decline from intraday high in mid-February to intraday low in early-March induced heavy buying.

- Changes in long-term relative strength of the RUT vs SPX tend to last for years, not months. This infers small-caps could be on the verge of outperforming their larger-cap counterparts for a long time -- albeit there could be short-term hiccups along the way.

Per my comments on Twitter after the close on March 24, the RUT was trading nearly 10% below the mid-March closing high, very similar to the mid-February to early-March price action. On March 24, the IWM closed at $212.04, with $210.60 corresponding to the level that was 10% below its March 15 closing high. After a brief move below $210.60 on Thursday morning, buyers indeed emerged.

The jury is still out as to whether the move from the Thursday morning lows will be sustained and followed by a move to new highs. If you did not act on getting into long positions on Wednesday afternoon or Thursday morning, it is likely best for traders to at least see a couple of closes above the IWM $221 level, which is the site of its 50-day moving average, and d an extended trendline that connected lower highs from February into March.

However, the $225 is another level of potential resistance, even if the IWM moves above $221 in the days ahead. The $2,225 level represents a breakeven point for those that bought the breakout above the trendline on March 10, as seen on the updated chart below. Absent the IWM getting above the $221-$225 area, we could see a retest of the Thursday morning lows at minimum.

In fact, while I like the fact that support levels I identified prior to Thursday’s low held, I do not like that this pullback has generated little fear among equity option buyers, which you will tend to see at significant troughs.

For example, when the IWM peaked earlier this month, the 10-day, cumulative buy-to-open put/call volume ratio on IWM components was at a historically low reading of 0.34 -- not very different than the current reading.

This would imply that rallies could be short-lived, like that of early-March to mid-March, which was resolved with an immediate retest of the early-March low last week. Higher levels of fear among equity option buyers on IWM components may be necessary before the next significant short-covering rally takes place in this group.

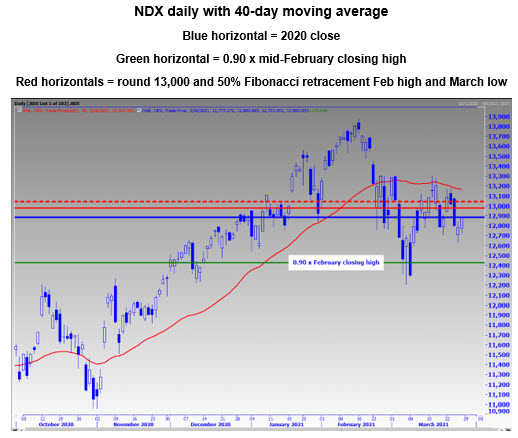

“If you are looking for technical permission to enter a bullish, large-cap technology trade… I think it is best if you look for resistance … to get taken out. Specifically…look for the NDX to climb back above a combination of its 40-day moving average, which marked last week’s peak. Plus, the 13,000 level and 13,037, which is a 50% Fibonacci retracement of the recent closing high and low, remain significant.”

- Monday Morning Outlook, March 22, 2021

If taking on equity risk, I still prefer small caps to large caps, especially relative to larger-cap technology stocks. While the NDX found a bottom earlier this month in an area 10% below its February high, the fear the pullback generated is unwinding, though the NDX failed at potential key resistance levels that I discussed last week.

Whether you key on round numbers, moving averages, Fibonacci retracements or year-to-date breakeven levels, the NDX comes into the week below 13,000, and its 2020 close at 12,888 (albeit barely). Moreover, a rally early last week was stopped at its declining 40-day moving average, after a Monday close above 13,037, or 50% retracement of the February high and low.

The second half of March has been nothing to write home about for this group, and the shorts are not helping matters, perhaps using rallies to re-establish short positions, per the near 7% increase in short interest on components of the Invesco QQQ Trust Series ETF (QQQ -- 316.00) in the latest short interest report. With short interest on QQQ components at multi-year lows, increasing shorting activity could present a major headwind that I do not see as big of a risk factor for the smaller cap names, per the charts below.

Whether it is the NDX or RUT, there is more work to be done as far as overcoming the short-term resistance level. But beyond the short-term technical backdrop, I would still emphasize smaller caps, as I would expect that if stocks rally, leadership will come from the small-cap names.

Todd Salamone is Schaeffer's Senior V.P. of Research

Continue reading: