Veritex board members departs after 10-year stint

Veritex Holdings, Inc. (NASDAQ:VBTX) is an American bank holding company that provides commercial banking services such as personal checking, business financing, investment, mobile banking, money market, and security through its wholly owned subsidiary, Veritex Community Bank. The company has locations throughout Dallas, Fort Worth, and Houston. Veritex Community Bank is also a Texas state-chartered bank regulated by the Texas Department of Banking and the Board of Governors of the Federal Reserve System.

Recently in the headlines, Veritex announced the departure of Ned N. Fleming III from their board of directors. Mr. Fleming was instrumental in helping to found Veritex 10 years ago, providing essential financial resources and guidance.

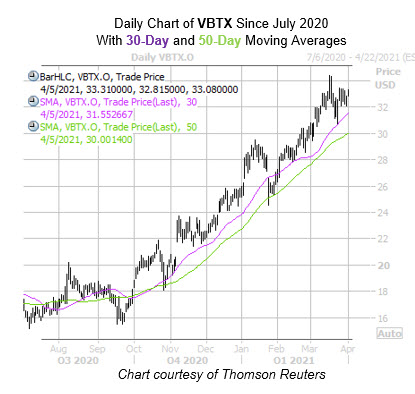

This morning, VBTX is up 1.3% at $33.27. The equity has added over 150% since touching its record low of $12.32 last April. Additionally, shares of Veritex have grown 29% year-to-date, with added support stemming from the 30- and 50-day moving averages.

From a fundamental point of view, Veritex offers something unique when compared to most of the large market cap banks. Put plainly, VBTX offers a much greater growth potential. However, the company also carries plenty of risks with it. For example, Veritex's balance sheet currently holds $1.07 billion in total debt with just $260 million in cash, making them less financially stable than what is typically expected for a company in the banking sector.

Nonetheless, Veritex’s financial growth has been phenomenal in recent years, with the exception of 2020, since 2017, the company has more than tripled its revenues. Veritex has also grown its net income by about 400%, even though the company took greater losses on the bottom line over this past year. Specifically, Veritex’s net profits fell by 29% in fiscal 2020.

Veritex stock currently trades at a price-earnings ratio of 22.19, which is a great value for a company with such a high growth rate. Overall, investing in Veritex stock now is a very interesting growth and dividend play from a risk-reward perspective.