SE is due to report quarterly earnings on May 18

Sea Limited (NYSE:SE) is a global consumer internet company headquartered in Singapore. Sea operates three core businesses across digital entertainment, e-commerce, as well as digital payments and financial services. Sea Limited’s businesses include Garena, Shopee, and SeaMoney. Garena is a global online games developer and publisher. This afternoon, SE is trading up 1.1% at $219.15.

Earlier this month, Sea Limited announced plans to release its first-quarter results before the market opens tomorrow, May 18. SE has swung and missed Wall Street's earnings expectations on all four of its most recent earnings reports.

For the first quarter of 2020, Sea Limited missed analyst estimates by a margin of $0.16 and reported an earnings per share (EPS) of -$0.52. For the second quarter of 2020, SE reported a decrease in earnings down to -$0.68 per share and missed expectations by a margin of $0.27. For the third quarter of 2020, Sea Limited posted another decrease in earnings, dropping to -$0.69 per share and missing estimates by a margin of $0.16. For the final quarter of 2020, Sea reported an EPS of -$0.87 and missed expectations by a margin of $0.33. For tomorrow's results, analysts are anticipating a quarterly loss of 0.53.

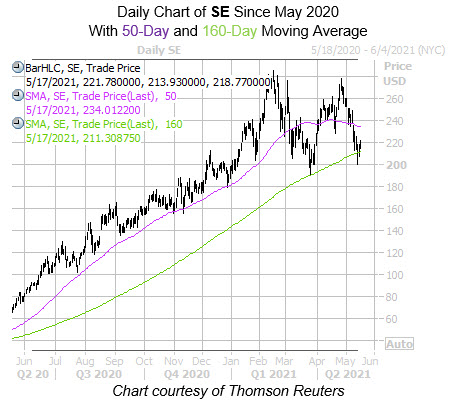

Sea stock price has increased 251% year-over-year, around the same time they hit the May 18 bottom of $65.43. Shares of SE has also grown 10% year-to-date. However, Sea Limited stock is trading down approximately 24% from its February record high of $285.00. Aiding the stock's long-term climb has been the 50-day and 160-day moving averages.

From a fundamental perspective, Sea Limited's biggest issue lies in its lack of profitability. For 2020, Sea Limited reported a net loss of $1.62 billion, which was a $160 million decrease compared to 2019 and a $1.06 billion decrease over the span of the past three years. Nonetheless, Sea Limited stock remains a promising growth play because of its massive revenue growth. In 2020 Sea Limited managed to double its revenues, generating approximately $4.4 billion in total sales.

In general, any company growing revenues at an exponential rate, like Sea Limited currently is, will always trade at an inflated stock price. SE is currently valued at $112.6 billion. Moreover, Sea Limited stock will continue to be a high risk and high reward stock play until the company proves it can turn profits from massive revenues.

The good news for options traders is that Sea stock has tended to exceed volatility expectations during the past 12 months. This is based on its Schaeffer's Volatility Scorecard (SVS) of 87 out of 100.