SKX is launching a marketing campaign starring Michael Ballack

Skechers U.S.A., Inc. (NYSE:SKX) is an American lifestyle and performance footwear company. SKX designs, develops, and markets a diverse range of lifestyle and performance footwear, apparel, and accessories for men, women, and children. Skechers' collections are available in the U.S. and over 170 other countries and territories via department and specialty stores. The company's products are also available directly to consumers through approximately 4,000 retail stores and e-commerce websites.

On June 8, Skechers announced the addition of German professional footballer, Michael Ballack, to the company’s marketing efforts. Skechers is set to launch a campaign starring the popular footballer in Germany and throughout Europe this year. The three-time German Footballer of the Year will appear in multi-platform marketing initiatives in support of the SKX's performance and lifestyle collections.

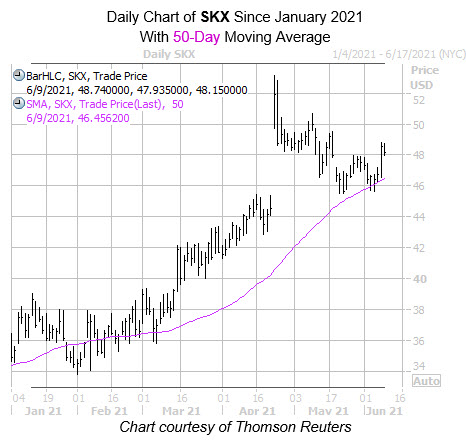

Skechers stock has increased nearly 40% year-over-year, and is now up a 78% since from its July 2020 bottom of $27.03. Additionally, shares of Skechers stock have grown 33% year-to-date, with support reemerging at the 50-day moving average in the past few weeks. This morning, SKX was last seen trading flat at $48.15.

Heading into this morning's trading, analysts were looking optimistic toward the security. Specifically, five of the eight covering brokerage firms carry a "buy" or "strong" buy recommendation, with not a "sell" in sight.

Overall, Skechers stock appears to be a promising recovery play right now. SKX’s revenues and net income are still down significantly compared to its pre-pandemic levels. However, had previously reported multiple years of consistent revenue and net income growth, suggesting that the company’s fundamentals are solid. Furthermore, SKX’s forward price-earnings ratio is estimated to come in at 21.41, which is a massive improvement compared to Skechers stock's current price-earnings ratio of 50.52.

Now actually looks like a nice time to buy premium on the security, too. This is per the stock's Schaeffer's Volatility Index (SVI) of 32%, which ranks in the 4th annual percentile, hinting at low volatility expectations at the moment.