The stock is flashing a bullish signal that could launch it to even higher records

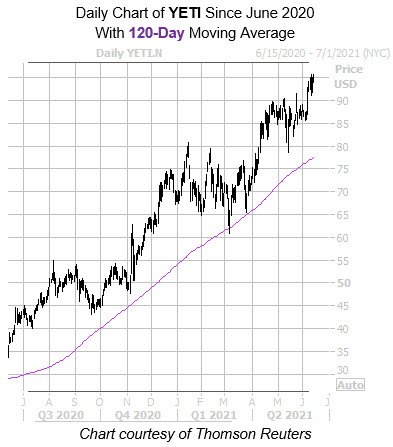

The shares of Yeti Holdings Inc (NYSE:YETI) are down 0.4% at $94.61 this afternoon, after hitting a fresh all-time high of $95.66 earlier in the session. The security has been tearing up the charts, up 165.5% year-over-year, with support from the 120-day moving average, which contained at least two pullbacks in March. In addition, the stock is flashing a historically bullish signal that may launch it even higher in the coming weeks.

Specifically, the equity's latest peak comes amid historically low implied volatility (IV), which has been a bullish combination for Yeti stock in the past. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, there have been four times over the past five years when the security was trading within 2% of its 52-week high, while its Schaeffer's Volatility Index (SVI) stood in the 20th percentile of its annual range or lower. This is currently the case with YETI's SVI of 38%, which sits in the 1st percentile of its 12-month range.

White's data shows that one month after these signals, the equity was higher 75% of the time, averaging a 12.8% return for that period. From its current perch, a move of similar magnitude would put YETI at a brand-new all-time high of $106.72.

The equity looks ripe for a short squeeze, too, which would push shares higher still. While short interest is down 4.3% over the last reporting periods, the 6.18 million shares sold short still account for 7.6% of the stock's available float, or over four days' worth of pent-up buying power.

A shift in the options pits could create additional tailwinds for the security. This is per Yeti stock's 50-day put/call volume ratio at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which stands in the 93rd percentile of its annual range. This indicates long puts are getting picked up at a faster-than-usual clip.

Lastly, the security's Schaeffer's Volatility Scorecard (SVS) ranks at 83 out of 100, implying the stock tends to outperform these volatility expectations -- a boon for option buyers.