The fitness center name is slated to report second-quarter earnings on Aug. 2

Fitness center name Planet Fitness, Inc. (NYSE:PLNT) is inching higher today, up 0.3% at $73.78 at last check. Though a reason for this positive price action was not immediately clear, the equity seems to be gearing up for its second-quarter earnings report, which is due out on Monday, Aug. 2. Below, we will further explore how the security has performed on the charts as of late, and dive deeper into some of its previous post-earnings activity.

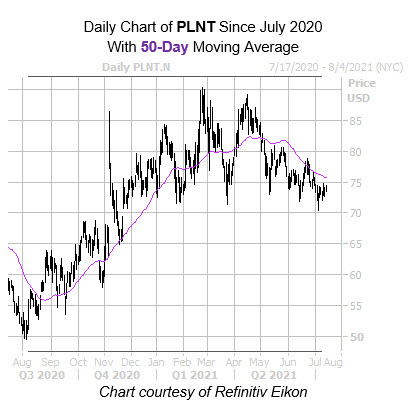

Planet Fitness stock has experienced its fair share of volatility over the past 12 months. More recently, the shares have been cooling off from a Feb. 25, all-time high of $90.34, despite attempting another rally towards those levels later in April. The security is now running into a ceiling at the $75 mark, while the 40-day moving average is keeping a tight lid on gains. Year-over-year, though, PLNT remains up roughly 26%.

The equity has had a generally negative history of post-earnings reactions over the last two years. Specifically, five of these next-day sessions were lower during the company's past eight reports, including a 6.8% drop in August 2020. In addition, PLNT averaged a post-earnings swing of 5.2% in the last eight quarters, regardless of direction.

From a fundamental perspective, Planet Fitness stock is struggling to recover from the effects of the Covid-19 pandemic. For fiscal 2020, PLNT's revenues fell by 41%, while its net income decreased by over $130 million. What's more, the security's trailing 12-month revenues are down 4%, and its trailing 12-month net income has decreased by over $3 million, compared to what was reported for 2020. Moreover, Planet Fitness holds $1.93 billion in total debt, and only $501.9 million in cash.

Now may be the right time to bet on PLNT's next move with options. The equity's Schaeffer's Volatility Index (SVI) of 40% sits in the 18th percentile of readings in its annual range, indicating options players are pricing in low volatility expectations at the moment.