“…the VIX proved to have limited upside last week. In fact, its Friday settlement was below its previous week’s close, and significantly below the key 33.20-34.44 area…Might the VIX be indicating lower volatility and a friendlier period for stocks in the weeks ahead, as the Federal Open Market Committee (FOMC) gets set to begin raising rates this expiration week, amid high inflation numbers? Something bulls can hang their hats on is that the VIX closed below a trendline connecting higher lows since early February. This could be a bullish signal for stocks and a sign of lower volatility ahead, just as the VIX’s break above a trendline connecting lower highs in early November signaled higher volatility ahead and with it, a challenging period for stocks.”

- Monday Morning Outlook, March 14, 2022

Stocks exploded higher and volatility expectation continued south last week, even after an initial negative reaction to the Federal Open Market Committee’s (FOMC) decision to raise the fed funds rate by 25 basis points. Clearly, market participants are worried about inflation, but showed relief when Federal Reserve Chairman Jerome Powell said the Fed would utilize all tools to fight inflation, including raising rates more than they projected just a few months ago.

As many market commentators fixated on the Cboe Market Volatility Index (VIX -- 23.87) being above 30 during the past few weeks, and just ahead of the FOMC’s decision, I continued to be fascinated at the pre-FOMC VIX highs on Monday and Tuesday. This was because they came in below the 33.20-34.44 area that I have been focusing on the past few weeks.

“…not all hope should be lost for bulls, as there was a potentially bullish development last Tuesday when the `SPX made a new closing low for 2022, but its 14-day Relative Strength Index (RSI) came in above its reading prior to the SPX’s closing low on Feb. 23. This is known as a bullish RSI divergence, as the SPX’s new closing low was not confirmed by a new low in its RSI reading…. But price action in major equity benchmarks is hardly squeezing the bears, nor forcing those on the sidelines back into the market. If you make commitments to the long side, be selective (emphasize the few stocks showing strong price action amid negative sentiment), or tiptoe in with small dollar amounts, if playing a broader market index.”

- Monday Morning Outlook, March 14, 2022

Last week at this time, there was little from a technical perspective to suggest bulls should be aggressive, even as sentiment indicators were implying the environment is right for a major bottom.

But as excerpted above, there was one technical development that gave bulls a glimmer of hope. This development, known as a bullish Relative Strength Index (RSI) divergence proved prescient, as it occurred just ahead of a breakout above potential resistance levels. In fact, a bullish RSI divergence emerged in late-September 2021 on this index and preceded a strong rally into early November. So if recent past is prologue, the next four to six weeks could be good for the bulls.

After a disappointing decline below various support levels such as the round 4,289-4,300 area that marked troughs since July and is roughly 10% below last year’s close, plus a close below its 320-day moving average (which has historically spelled trouble for stocks in the weeks ahead), the S&P 500 Index (SPX -- 4,463.12) quickly moved back above these levels in a convincing manner.

More importantly, both the SPX and NASDAQ 100 Index (NDX -- 14,420.08) moved above the top rails of their respective declining channels that began to develop late last year, when the Fed began hinting at a more hawkish policy, which we saw materialize last week. From that perspective, it is interesting that these benchmarks moved out of these channels on the heels of the Fed raising rates. It might be that market participants have moved from concerns that the economy was not in a place to handle rate hikes, to a new belief that rate hikes are needed and welcomed.

The next big resistance level for the SPX to overtake is 4,600, which marked its highs in early February. If you are more aggressively playing the SPX’s breakout above resistance, you might think about lightening your position if the SPX moves back below the top rail of its channel, which begins this week at 4,360 and ends the week at 4,325. Unfortunately, since the top rail of this channel is sloping lower, your risk increases as time passes. Therefore, another level to focus on is the one from which the index broke out above the top rail, which is 4,375.

If your time frame is weeks or months, I find it interesting that at the end of the month, the top rail of the declining channel will be at 4,291, which is the 4,289-4,300 vicinity discussed above and in prior commentaries. Use this area to define your risk. With an anticipated SPX move up to the January high around 4,725, sentiment could shift, if the technical breakout last week acts as a trigger.

“Hedge funds have dramatically scaled back their footprint in the US stock market as sharp swings have pummeled big money managers. Funds that trade with some of the largest banks on Wall Street including Morgan Stanley, Goldman Sachs and JPMorgan Chase have rapidly cut long and short stock positions, or bets on prices rising or falling, according to interviews with traders and data that the banks have circulated to their clients…Morgan Stanley last week notified clients that they had seen one of the largest five-day periods of selling in North American stocks by hedge funds on record”

- Financial Times, March 16, 2022

There is anecdotal evidence of major traders and investors throwing in the towel, as depicted in the excerpt above. Various surveys, polls and the action of equity option buyers confirm the pessimism that preceded a technical breakout last week in major equity benchmarks.

In fact, note immediately below how the 10-day buy (to open) put/call volume ratio on NASDAQ 100 Index components is nearing the extreme level of early 2020, which marked a huge bottom for the equity market. This comes as the NDX climbed back above the key 14,000-millenium level, which is double its 2020 closing low.

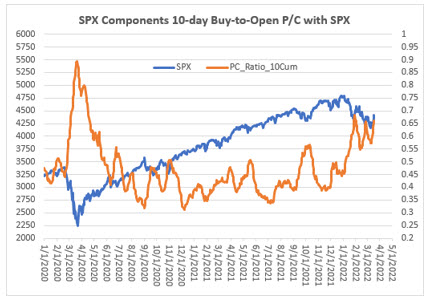

Moreover, per the chart below, note that the 10-day buy (to open) put/call volume ratio on SPX components has climbed significantly since its Feb.11 trough, when the index closed at 4,418. This could represent a period of building bets against the market and/or market participants moving to the sidelines. So if the SPX is above 4,418, those recent bet against the market are underwater, or it could mark a level at which those who moved to the sidelines are missing out, and thus bring in willing buyers.

It may be worth noting that with portfolio insurance, as measured by the VIX, 30% below its recent high, and less than 50% above this year’s closing low, potential investors may view hedging as “cheap enough” and thus more willing to take risks on the equity side and hedge with index or exchange-traded fund options.

Todd Salamone is Schaeffer's Senior V.P. of Research

Continue Reading: