Increased volatility may lie ahead

In the latest Monday Morning Outlook, our own Senior Vice President of Research Todd Salamone noted this is an end-of-quarter month, which tends to see big put open interest builds for the major indexes. When strike levels with large put open interest are in danger of getting broken, it can lead to bigger than normal selloffs, because market makers must short futures to hedge the puts they sold. The table below shows the implications of that.

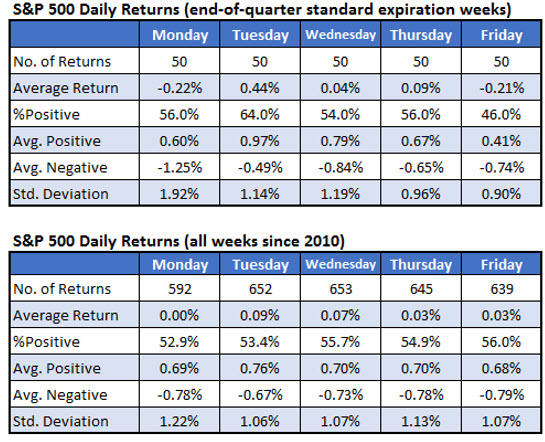

The data below goes back to 2010. Over the 10 days leading into standard expiration (the third Friday of the month) of an end-of-quarter month, the S&P 500 (SPX) averages a loss of 0.21%. Meanwhile, the 10-day return heading into other weeks averages a gain between 0.45% and 0.49%.

The underperformance occurs in these specific months despite the percent positive being typical for a 10-day period, and the average return is negative because losses have been bigger than normal, as you can see by the average negative below.

End-of-Quarter Expiration Week

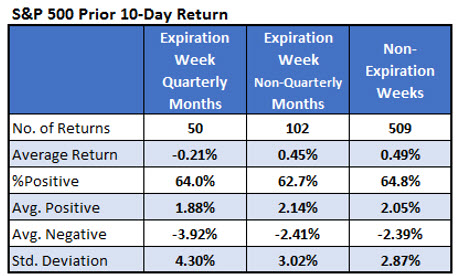

The table below breaks down weekly SPX performance by end-of-quarter expiration weeks, other expiration weeks, as well as non-expiration weeks. These end-of-quarter expiration weeks are also known as quadruple witching weeks, because they mark the expiration of index futures, index options, stock options, and single-stock futures.

With all these contracts expiring, quadruple witching weeks are said to bring increased volatility. The data below supports this claim. The standard deviation of returns during expiration week in these quarterly months is significantly higher than other weeks.

This has been especially true to the downside, as explained above, where the average negative return is roughly -2.5%, compared to average negative returns of about 1.5% during non-quarterly expiration weeks, and around -1.7% in other weeks. Even though the SPX averages a gain for the week (interestingly, given the 10-day data above), the downside risk remains.

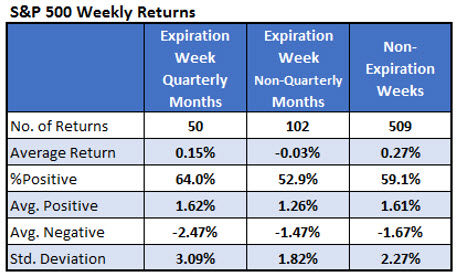

Finally, the table below breaks down these end-of-quarter expiration weeks by day. The second table is for comparison. Based on these numbers, traders should be reluctant to hold over the weekend, as Monday has been the worst day of the week averaging a loss of 0.22%. The average loss on down Mondays has been 1.25%.

Turnaround Tuesday has been, by far, the best day of the week, averaging a gain of 0.44%. That’s huge compared to the other days of the week, or to a typical Tuesday, which has averaged a gain of 0.09%.

The only day of the week that has been lower more times than higher is expiration day. Friday of end-of-quarter standard expiration weeks has been positive just 46% of the time, which has led to an average return of -0.21%.

Notably, quadruple-witching expiration day, based on the standard deviation of returns and the average positive and average negative, has been less volatile than typical Fridays.