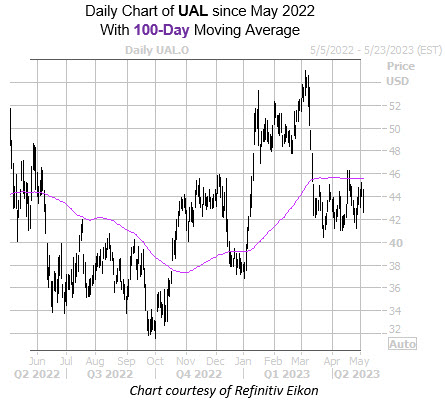

UAL has pulled back to a historically bearish trendline on the charts

United Airlines Holdings Inc (NASDAQ:UAL) has just come within one standard deviation of its 100-day moving average for the sixth time in the past three years. According to Schaeffer's Senior Quantitative Analyst Rocky White, UAL was lower one month later after every signal, averaging a 12.6% loss.

United Airlines stock is currently down 3% at $43.16, and a similar move would place the equity below the $38 level for the first time since the very start of the year. Peer Delta Air Lines' (DAL) new pilot contract is likely weighing on the equity today, after they offered $7 billion in higher pay and benefits, putting pressure on United and Southwest, who are currently in the middle of contract negotiations with their pilots.

A downgrade or two could push United Airlines stock lower as well, as the majority of analysts are bullish. Of the 16 analysts in coverage, 12 carry a "buy" or better rating.

Now looks like a good time to weigh in with options. The stock is seeing attractively priced premiums at the moment, per UAL's Schaeffer's Volatility Index (SVI) of 40%, which sits in the low 11th percentile of its annual range.