APPS just pulled back to a historically bearish trendline on the charts

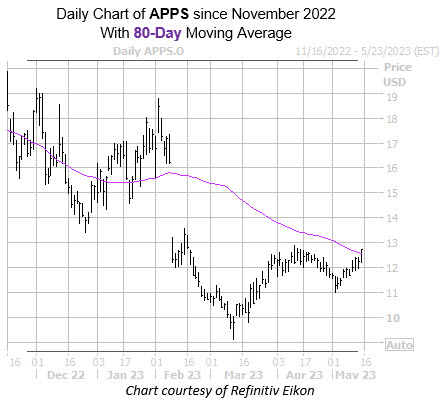

Digital Turbine Inc (NASDAQ:APPS) stock, fresh off two-straight weeks of gains, is up 3.8% to trade at $12.71 at last glance. However, in mid-April, APPS ran out of steam at this level and it's now within one standard deviation of its 80-day moving average -- a trendline with historically bearish implications.

According to Schaeffer's Senior Quantitative Analyst Rocky White, Digital Turbine stock ran into this bear signal five times in the last three years. The stock was lower one month later every time, averaging a loss of 14.2%. A similar move would place the equity below the $11 level, which propped up the shares in their most recent pullback.

Bear notes could provide headwinds as well, as four of the six in coverage carry a "strong buy" rating. Plus, the 12-month consensus price target of $14.83 is a 16.6% premium to current levels.

Now looks like a good time to weigh in on Digital Turbine stock's next move with options. This is per APPS' Schaeffer's Volatility Index (SVI) of 82%, which sits in the 26th percentile of its annual range.