Unpacking Microsoft stock's recent milestones

It’s been awhile since we reviewed market caps in this space, and by a while, we mean only a few weeks. It’s also been some time since we checked in on tech leader Microsoft (MSFT). Given some recent headlines and milestones, I wanted to dig deeper into the impact of MSFT being the second company to reach the $2 trillion market-cap level -- after Apple (AAPL), of course -- and weigh some of the implications of said news-driven reports possibly driving this recent surge.

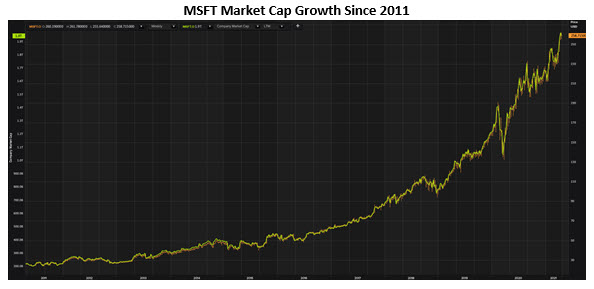

First unpacking the $2 trillion market-cap milestone, Microsoft could be looking at this level as support in the coming weeks and months. Even further, MSFT hosts a price-to-revenue of 13, a lofty reading compared to AAPL’s 8. The chart below shows Microsoft’s long-term market-cap movement since 2011 -- the stock boasting an impressive growth pattern in stride with the equity’s shares. The two are continuing their run neck-and-neck, with the market cap growth seeing pullbacks on only the rarest of occasions.

Digging into some of the news that has been driving Microsoft into headlines over the past month is the company’s interest in buying online streaming platform Discord. Back in late March, Bloomberg reported that the tech behemoth was in talks to buy Discord for more than $10 billion. Discord reportedly reached out to multiple buyers, and VentureBeat said that the company is in final sales talks with at least one party. However, another person familiar with the matter said the company is more likely to go public. This buzz sent MSFT up near $240 for the first time since February, but simmered this past Tuesday, April 20, when Reuters and several other media outlets reported Discord had chosen to move forward independently in its company growth. This update did little to sway investors, however, as MSFT remained within a chip-shot of its April 19, then record high, $261.48.

Even more recent, Microsoft stock enjoyed a fresh bull note Thursday night from Wolfe Research. Analyst Alex Zukin initiated coverage with an "outperform" rating and $290 price target. An optimistic approach, considering Zukin’s price target boasts a 12.8% premium to the equity’s Thursday close. However, this is not to dismiss Microsoft’s impressive midday surge to a fresh record peak of $261.78 earlier in the day. Zukin cited that the company appeared fully valued "on the surface, " but one of the few names to continue its growth "in the black" in the coming months.

For the contrarian trader, however, there remains room for further upgrades on the equity, with four covering brokerage firms still sporting a tepid "hold" recommendation on Microsoft stock. Plus, now looks like the ideal time to bet on MSFT, as options are looking like an affordable purchase. This is per the stock’s Schaeffer's Volatility Index (SVI) of 26%, which stands in the 19th percentile of its annual range, suggesting that options players are pricing in lower-than-usual volatility expectations at the moment.

Subscribers to Bernie Schaeffer's Chart of the Week received this commentary on Sunday, April 25.