The Dow secured a seventh straight win, despite a down day for bank stocks

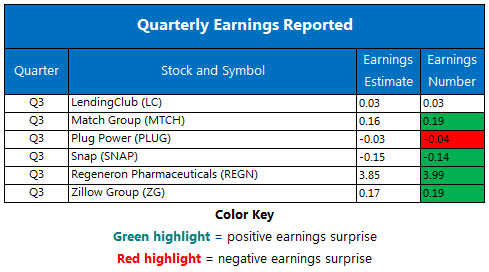

After trading in a narrow range on both sides of breakeven, the Dow Jones Industrial Average (DJIA), S&P 500 Index (SPX), and Nasdaq Composite (IXIC) all managed to close higher, marking the Dow's seventh straight win. Traders ultimately shrugged off disappointing earnings from Snap (SNAP) and extended weakness in bank stocks, caused by doubt surrounding the Republican tax plan following yesterday's local elections. The Senate GOP is expected to release its tax bill before the end of the week.

Continue reading for more on today's market, including:

- This stock's "buy" signal hasn't been wrong in years.

- Behind Match stock's new record high.

- The red-hot housing stock that could cool off, if history repeats.

- Plus, the video game stock to watch this month; the stock market's record-shattering year; and warning signs for this defense stock.

The Dow Jones Industrial Average (DJIA - 23,563.36) ended with a gain of 6.1 points, or 0.03%, for a record closing high. Merck (MRK) led the 13 Dow gainers with a 1.8% advance, while JPMorgan Chase (JPM) paced the 17 losers with a 1.1% drop.

The S&P 500 Index (SPX - 2,594.38) closed up 3.7 points, or 0.1%, while the Nasdaq Composite (IXIC - 6,789.12) ended with a gain of 21.3 points, or 0.3%. Both indexes finished at record closing highs.

The CBOE Volatility Index (VIX - 9.78) lost 0.1 point, or 1.1%.

5 Items on Our Radar Today

- In order for AT&T to acquire Time Warner for $84.5 billion, the Justice Department is reportedly requiring the sale of Time Warner's CNN, which President Trump claims is "fake news." AT&T is reportedly prepared to take the Trump administration to court over the negotiations. (MarketWatch)

- Apple is designing a new augmented reality headset that will succeed the iPhone. The new headset, which could be on the market by 2020, will use its own chip and operating system to display three-dimensional videos and images. (Bloomberg)

- Buy calls on this video game stock, if past is prologue.

- How 2017 is unprecedented for the stock market, and why 2018 could be even better.

- The outperforming defense stock that could be ready for a retreat.

Data courtesy of Trade-Alert

Commodities

Crude prices settled lower again today, after weekly data showed a surprise increase in U.S. crude stockpiles and domestic production at the highest since at least 1983. December-dated oil futures ended down 39 cents, or 0.7%, at $56.81 per barrel.

Meanwhile, gold closed higher today, as the U.S. dollar retreated on possible delays in tax reforms. December-dated gold ended up $7.90, or 0.6%, at $1,283.70 an ounce.