Oil prices, on the other hand, continue to rise

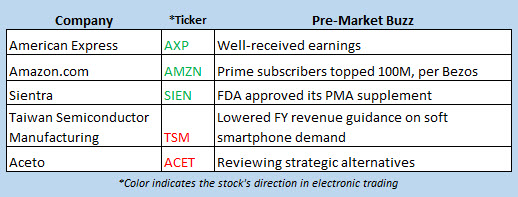

Dow Jones Industrial Average (DJI) futures are below fair value, pressured by a negative earnings reaction for Procter & Gamble (PG) and pre-market downside for Apple (AAPL). Shares of the iPhone maker are 1.8% lower ahead of the bell, after Taiwan Semiconductor (TSM) pointed to weak smartphone demand in its dreary full-year revenue forecast. TSM also flagged uncertainty in the cryptocurrency mining market -- sending chip stocks spiraling in electronic trading. Futures on the S&P 500 Index (SPX) and Nasdaq-100 Index (NDX) are lower, too, even as May-dated oil prices climb 1.3% to trade at $69.38 per barrel -- a level not seen since late 2014 -- ahead of tomorrow's production review between the Organization of the Petroleum Exporting Countries (OPEC) and other major crude producers.

Continue reading for more on today's market, including:

- Analyst: Buy the dip on this chip stock.

- Options bulls blasted this surging solar stock.

- 2 restaurant stocks targeted for breakouts.

- Plus, Alcoa eyes new highs; a big pharma buyout may be in the works; and more on Procter & Gamble.

5 Things You Need to Know Today

- The Chicago Board Options Exchange (CBOE) saw 1.08 million call contracts traded on Wednesday, compared to 604,574 put contracts. The single-session equity put/call ratio fell to 0.68, while the 21-day moving average dropped to 0.66.

- Alcoa Corp (NYSE:AA) reported better-than-expected adjusted first-quarter earnings of 77 cents per share on in-line revenue of $3.1 billion, and boosted its full-year forecast, citing favorable market conditions in the wake of U.S. sanctions on Russia-based aluminum producer Rusal. A round of price-target hikes is adding to the bullish bias, with AA stock up 4.3% in electronic trading -- set to open at a post-split record high.

- Japan's Takeda Pharmaceutical said it is still in talks with Shire PLC (NASDAQ:SHPG) about a possible takeover, though the Irish drugmaker reportedly rejected a previous cash-and-stock bid that valued the firm at around $61 billion. SHPG stock is trading 2% higher ahead of the bell, on track to extend its recent breakout above its 200-day trendline.

- Procter & Gamble Co (NYSE:PG) reported stronger-than-forecast fiscal third-quarter earnings of $1.00 per share, excluding items, on $16.28 billion in revenue -- slightly beating the consensus estimate. The company also said it is buying the consumer health business of Germany's Merck KGaA for around $4.2 billion, and said it's ended its joint venture with Teva Pharmaceutical (TEVA). PG stock is down 2.9% in premarket trading, and could open near its March 23 annual low of $75.81.

- Weekly jobless claims, the Philadelphia Fed business outlook, the Fed's balance sheet, and the Conference Board's index of leading economic indicators are due out today. BB&T Corp (BBT), Blackstone Group (BX), E*TRADE Financial (ETFC), KeyCorp (KEY), Nucor (NUE), Philip Morris International (PM), and The Tile Shop (TTS) will report earnings.

Steel Stocks Lift Nikkei on Trump Trade Talk

Stocks in Asia finished higher today, driven forward by energy stocks as Brent crude futures extended the prior session's surge to multi-year highs. Japan's Nikkei added 0.2%, led by strength in steel stocks after U.S. President Donald Trump indicated Japan may be exempted from tariffs on steel and aluminum if a bilateral trade deal is reached. South Korea's Kospi followed suit, gaining 0.3% despite a firming won, thanks to major gains for manufacturing names like Hyundai Engineering & Construction, which settled up 12.2%. Hong Kong's Hang Seng added 1.4%, while China's Shanghai Composite climbed 0.9%.

Markets in Europe are sluggish at midday. London's FTSE 100 is up 0.2% at last check, with gains held in check by weaker-than-expected retail sales data and a tepid forecast from consumer goods giant Unilever. The French CAC 40 is 0.1% higher, propped up by a 7.8% surge from Publicis Groupe after the firm reported better-than-expected sales growth. Lastly, the German DAX is off 0.3%, with finance giant Deutsche Bank trading lower after Chief Operating Officer Kim Hammonds announced her plan to depart the company after the May 24 annual meeting.