The DJI is eyeing its longest winning streak since September

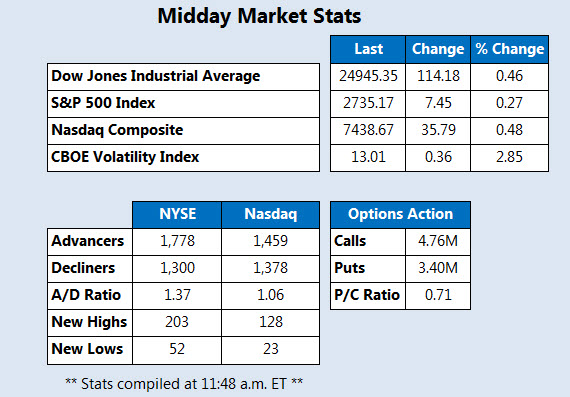

U.S. stocks are higher in afternoon trading, with the Dow Jones Industrial Average (DJI) pacing toward its eighth straight gain -- which would represent its longest winning streak since September. The S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are also higher at midday, with the majority of today's surge attributable to easing trade tensions between China and the U.S. This morning, President Donald Trump tweeted that the two countries are working together to get ZTE Corp "back into business, fast." In mid-April, the Commerce Department issued a seven-year ban on U.S. companies selling to ZTE.

Continue reading for more on today's market, including:

- 3 tech stocks surging on the Trump tweet.

- Analyst: Amazon could charge much more in Prime fees.

- Plus, the SCOTUS ruling lifting casino stocks; why Tailored Brands is a buy; and the semiconductor at two-year lows.

Casino name Caesars Entertainment Corporation (NASDAQ:CZR) is sporting unusual options volume today, with roughly 38,000 calls traded so far -- nine times what's typically seen at this point in the day. Seeing the most action is the weekly 5/25 13-strike call, which is likely being bought to open by option bulls. Casino stocks are higher today after a Supreme Court (SCOTUS) ruling paved the way for states to legalize sports betting. CZR is 7% higher at $12.68, at last check, and has gained 14% over the past month.

The top performer on the New York Stock Exchange (NYSE) is Men's Wearhouse parent Tailored Brands Inc (NYSE:TLRD), after the stock received an upgrade to "buy" from "hold" and a price-target hike to $40 from $30 at Jefferies. TLRD stock is 12% higher at $35.40, at last check, fresh off a two-year high of $35.88.

One of the Nasdaq's worst performers today is tech concern Alpha and Omega Semiconductor Ltd (NASDAQ:AOSL), after Stifel downgraded the stock to "sell" from "hold" and sliced its price target to $13 from $16. AOSL stock is down 14% at $13.91, just off a nearly two-year low of $12.92.