The DJI is up triple digits on reports of new trade talks with China

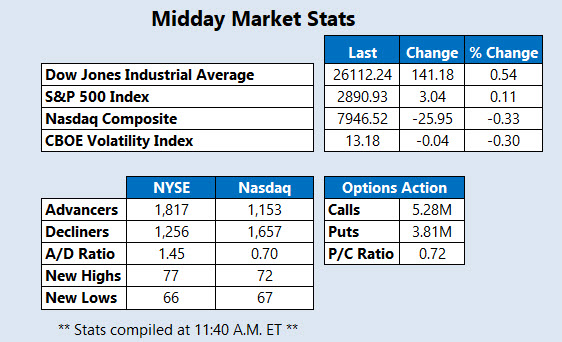

Stocks are mixed this afternoon, with the Dow Jones Industrial Average (DJI) and S&P 500 Index (SPX) higher on reports the U.S. is proposing fresh trade talks with China. On the other hand, a plunge from Micron Technology (MU) and other semiconductor stocks is pulling the Nasdaq Composite (IXIC) lower, with Apple (AAPL) stock also in the red ahead of today's highly anticipated product event. Elsewhere, October-dated crude futures are up 2.2% at $70.76 per barrel, at last check, as traders eye a steep drop in domestic inventories and await Hurricane Florence.

Continue reading for more on today's market, including:

- The drug stock rallying on upbeat data.

- 3 penny stocks making huge moves today.

- Plus, Cypress stock's unusual options volume; the oil name set to join the S&P SmallCap 600; and another semiconductor stock slammed by a downgrade.

Cypress Semiconductor Corporation (NASDAQ:CY) is sporting unusual options volume today, as the stock succumbs to sector headwinds. Roughly 12,000 calls and 9,000 puts have crossed the tape so far -- around seven times the average intraday pace. The January 2019 13-strike call is among the most active for CY, with just over 6,300 contracts traded. Cypress stock has had a volatile year on the charts, stuck between $14.50 and $18.50. The security is just below breakeven year-to-date, and down 3.4% at $14.93, at last check.

Laredo Petroleum Inc (NYSE:LPI) is one of the top stocks on the New York Stock Exchange (NYSE) today, as the oil concern will gain a spot on the S&P SmallCap 600 Index on Sept. 17. LPI has gapped 7.3% higher to $8.30 in response, softening its year-to-date deficit to 21%. Overall the shares have had a rough go on the charts in 2018, but have managed to tack on 12% from their mid-February lows.

Near the bottom of the Nasdaq today is MACOM Technology Solutions Holdings Inc (NASDAQ:MTSI), after the semiconductor stock received a downgrade to "sell" from "hold" and price-target cut to $20 from $22 at Stifel. MTSI has gapped back below the $20 mark, and is close to erasing its early May bull gap that helped pulled the tech name from its April 4 bottom. The security is down 13.7% at $18.97, at last check.