The 10-year Treasury yield is at seven-year highs

It's shaping up to be another risk-off session on Wall Street, as rising bond yields continue to put pressure on stocks. The yield on the 10-year Treasury note has edged up to a seven-year high, sending stock futures sharply lower. The Dow Jones Industrial Average (DJIA) is eyeing a nearly 70-point pullback, while the S&P 500 Index (SPX) and Nasdaq-100 (NDX) are both set for lower opens, too. As such, the Cboe Volatility Index (VIX) could keep rising.

Continue reading for more on today's market, including:

5 Things You Need to Know Today

- The Chicago Board Options Exchange (CBOE) saw 879,048 call contracts traded on Monday, compared to 578,116 put contracts. The single-session equity put/call ratio fell to 0.66, and the 21-day moving average stayed at 0.60.

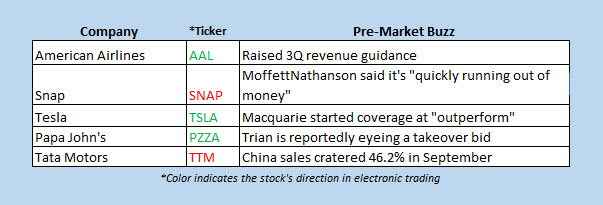

- Papa John's International, Inc. (NASDAQ:PZZA) is up 8.8% before the open following reports that Trian Fund Management is considering a takeover bid for the embattled pizza chain. PZZA stock has struggled under the pressure of its 160-day moving average, with the shares down 18.4% in the past six months.

- After jumping nearly 37% in yesterday's trading thanks to a bullish recommendation from Citron Research, Pyxus International Inc (NYSE:PYX) is set to add another 21% this morning. The stock already notched a five-year closing high yesterday, and these pre-market gains would put it in territory not seen since 2010.

- Alibaba Group Holding Ltd (NYSE:BABA) is trading lower before the open, down 2.2% and set for fresh annual lows. The Chinese tech giant has been getting clobbered since its June peak of $211.70, down 21.6% in the past three months, with the planned exit of founder Jack Ma last month adding to the uncertainty.

- The economic calendar remains bare today, but Chicago Fed President Charles Evans and New York Fed President John Williams will speak. Helen of Troy (HELE) will report earnings.

Healthcare Stocks Lead European Markets Lower

Markets in Asia were in recovery mode today, with the exception of Japan's Nikkei, which returned from public holiday with a 1.3% drop, as it played catch-up with yesterday's regional sell-off and electronics stocks weighed heavy. Hong Kong's Hang Seng gave back 0.1%, though China's Shanghai Composite managed a 0.2% gain. Markets in South Korea were closed for holiday.

European stocks are lower in afternoon trading, amid rising tensions between the European Union and Italy on the latter's budget woes. Healthcare stocks are vastly underperforming, while German industrial companies cautioned against risks of a no-deal Brexit. At last check, London's FTSE 100 and France's CAC 40 are both down 0.6%, while Germany's DAX is 1% lower.