Congress has yet to pass a spending bill to avoid a partial government shutdown at midnight

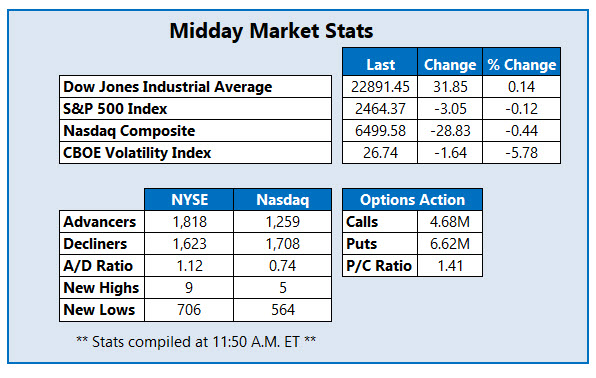

The Dow Jones Industrial Average (DJI) was last seen modestly higher -- getting help from a post-earnings bull gap for Nike (NKE) -- overcoming a brief turn lower as a potential government shutdown looms. Traders are also reacting to a round of lackluster economic data, with the personal consumption expenditure (PCE) index, a key measure of inflation for the Fed, rising a lower-than-expected 0.1% last month. This volatile price action just echoes what's been seen on Wall Street this month, with the Dow, S&P 500 Index (SPX), and Nasdaq Composite (IXIC) all headed for stiff weekly losses.

Continue reading for more on today's market, including:

- History says to drop this retail stock right now.

- Skepticism ramps up on Facebook stock with a fresh "sell" rating.

- Plus, GE options trader positions for earnings; the drug stock at the bottom of the SPX; and CarMax catches options bears off guard.

General Electric Company (NYSE:GE) is seeing unusual options volume today, with more than 472,000 puts traded so far -- 10 times what's typically seen at this point, and volume pacing in the 100th annual percentile. Trade-Alert pegs a possible bearish roll from the January 2019 6-strike puts to the weekly 2/1 6-strike puts, the latter of which encompass GE earnings, due the morning of Thursday, Jan. 31. GE stock is down 1.5% at $7.33, but is still set for a weekly win after being upgraded again on Wednesday.

Perrigo Company PLC (NYSE:PRGO) is at the bottom of the S&P 500 today, after the Dublin-based over-the-counter pharmaceutical firm was ordered to pay the Irish government $1.9 billion in back taxes. PRGO stock is down 24.1% to trade at $39.73, earlier hitting a nearly nine-year low of $39.52.

CarMax, Inc (NYSE:KMX) is near the top of the SPX today, boosted by the used car retailer's third-quarter earnings beat. After trading lower ahead of the bell, KMX stock was last seen up 5.9% at $60.09 -- catching

options bears off guard.