The blue-chip index is shrugging off a slashed sales forecast from Home Depot

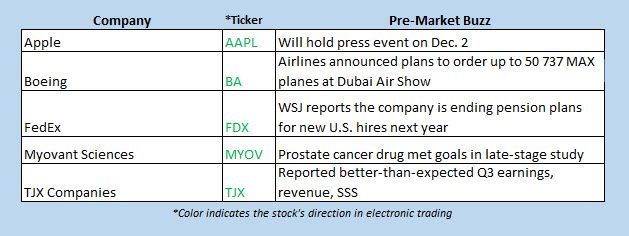

Dow futures are on pace for yet another record high today, boosted by pre-market strength for Boeing stock after the aerospace giant attracted over 50 orders for its contentious 737 Max jet during the Dubai Air Show. This news is helping to offset abysmal earnings from Home Depot, with HD stock sliding more than 3% ahead of the bell after same-store sales missed analysts' estimates.

Elsewhere, investors are poring over a 12-year high in October building permits, while President Donald Trump tweeted that he "protested... that our Fed Rate is set too high" during his Monday meeting with Fed Chair Jerome Powell.

Continue reading for more on today's market, including:

- Options bulls pile on Amazon stock amid EU probe.

- Inside a roughly $8M bet on Micron earnings volatility.

- Plus, Kohl's earnings miss the mark; Guggenheim downgrades MSGN stock; and demand for Alibaba's Hong Kong IPO skyrockets.

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw 1.30 million call contracts traded on Monday, compared to 720,252 put contracts. The single-session equity put/call ratio moved up to 0.55, while the 21-day moving average came in at 0.61.

- Department store operator Kohl's Corporation (NYSE:KSS) is down 13.4% in electronic trading after the firm posted third-quarter earnings of 74 cents per share and 0.4% same-store sales growth -- both of which fell below analysts' expectations. KSS also slashed its full-year earnings outlook.

- MSG Networks Inc (NYSE:MSGN) is sinking today on a Guggenheim downgrade to "sell" from" neutral." The analyst expressed concern as the firm approaches several contract renewals covering roughly 40% of its subscriber base. The stock is down 4.5% ahead of the open.

- The shares of Alibaba Group Holding Ltd (NYSE:BABA) are inching higher this morning after a CNBC report said the China-based e-commerce company was closing the books early on its Hong Kong IPO, due to higher-than-expected demand. The stock is up 0.7% in electronic trading.

- The National Association of Home Builders (NAHB) housing market index is due out today. New York Fed President John Williams will speak. Earnings are expected from 58.com (WUBA), JinkoSolar (JKS), TJX Companies (TJX), and Urban Outfitters (URBN).

Asian Markets Mixed as Investors Await More U.S.-China Trade Headlines

Markets in Asia were a mixed bag today. There was little to be found in terms of data releases, so investors remained cautious ahead of the next U.S.-China trade headlines. China's Shanghai Composite added 0.9%, while Hong Kong's Hang Seng shook off political unrest to tack on 1.6%. Japan's Nikkei gave back 0.5% amid a rough outing from automation stock FANUC, while South Korea's Kospi edged lower by 0.3%.

Over in Europe, stocks are brushing off the U.S.-China trade uncertainty and advancing higher. London's FTSE 100 is up 1.2% at last check, powered by big days from tech stock Halma and airliner easyJet. Rounding out the region, the French CAC 40 is up 0.3%, while the German DAX is 0.9% higher.