The European Union passed a $857 billion coronavirus relief fund

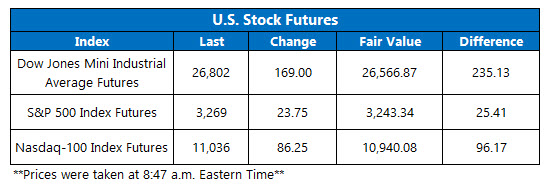

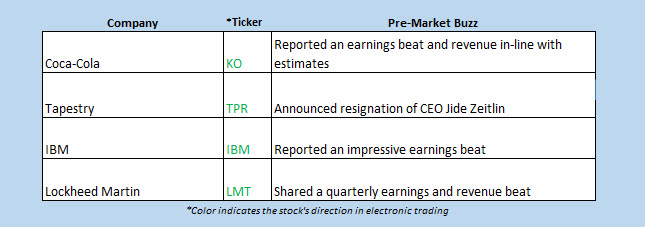

Dow Jones Industrial Average (DJI) futures are looking at a big push above fair value this morning, buoyed by the latest batch of upbeat corporate reports. Blue-chips Coca-Cola (KO) and IBM (IBM) are in focus, after both reported second-quarter earnings that surpassed analysts' projections. Futures on the S&P 500 Index (SPX) and Nasdaq-100 Index (NDX) are also eyeing outsized opens as optimism grew after Monday's daily count of cornavirus cases increased by the smallest in a week. Meanwhile, overseas the European Union (EU) agreed on an $857 billion relief package, while back in the U.S., House Minority Leader Kevin McCarthy said another stimulus bill for the states most likely won't be passed until at least August.

Continue reading for more on today's market, including:

- Schaeffer's Senior Market Strategist Matthew Timpane has a theory about this all-important sentiment ratio.

- Digging into AstraZeneca's options pits after its big vaccine update.

- Plus, Lockheed Martin scores beat-and-raise; Prime Day postponed; and Novartis regrets exiting the vaccine game.

5 Things You Need to Know Today

- The Cboe Options Exchange

(CBOE) saw 1.7 million call contracts traded on Monday, and 749,290 put

contracts. The single-session equity put/call ratio slipped to 0.45, and the

21-day moving average fell to 0.49.

- Lockheed Martin Corporation (NYSE:LMT) stock is up 4% in electronic trading, after the defense contractor reported second-quarter earnings and revenue that topped analyst forecasts. The company also upped its full-year guidance. LMT will look to face off with its year-to-date breakeven point today.

- Amazon.com Inc (NASDAQ:AMZN) stock is 2% higher ahead of the open, set to build on yesterday's big day. The e-commerce giant announced it was delaying its vaunted Prime Day, with the new date likely later this year. Evercore ISI also chimed in with a price-target hike to $3,250 from $2,450 today. AMZN is up 73% in 2020.

- The shares of Novartis AG (NYSE:NVS) are off by 1.4% before the bell, after the pharmaceutical company cut its 2020 sales outlook. Novartis exited the vaccine market six years ago. NVS is down 7% year-to-date, with pressure forming at the shares' 160- and 200-day moving averages.

-

Today will bring the Chicago Fed national activity index in terms of economic data. Meanwhile, Capital One Financial (COF), Philip Morris (PM), Snap (SNAP), Teradyne (TER), Texas Instruments (TXN), and United Air Lines (UAL) will all step in to the earnings confessional.

Overseas Sentiment Rises on Vaccine News, EU Relief Fund

Stocks in Asia closed higher today, after investor sentiment was uplifted by a slew of positive news regarding an effective coronavirus vaccine, as well as Wall Street’s overnight gains in tech. Hong Kong’s Hang Seng closed 2.3% higher, leading the charge, while South Korea’s Kospi rose 1.4%. Elsewhere, Japan’s Nikkei and China’s Shanghai Composite closed 0.7% and 0.2% higher, respectively.

Across the pond stocks are also higher, after European Union (EU) leaders reached a deal on a $857 billion relief fund to help the region recover from the economic impact of the coronavirus pandemic. At last check, the German DAX was up 1.7%, France’s CAC was up 1.2%, and London’s FTSE 100 was up 0.5%.