Big Tech, and uncertainty concerning additional stimulus sunk stocks

September's mean streak is showing no signs of slowing down, as stocks fell sharply during today's session alongside shares of major tech stocks. The Dow closed up shop 525 points lower, after earlier trading nearly 200 points above fair value, as shares of FAANG stocks all slid considerably. Elsewhere, the S&P 500 and Nasdaq fell, too, as investors continue to digest the plethora of information regarding rising COVID-19 cases and uncertainty surrounding another U.S. fiscal stimulus.

Continue reading for more on today's market, including:

- Cummins stock gears up for a move higher.

- JNJ is surging on vaccine buzz, but the rise could be cut short.

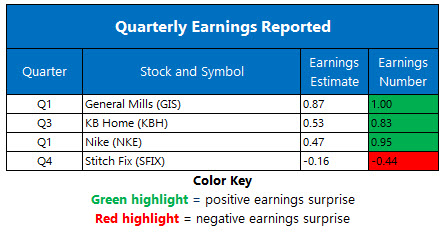

- Plus, more on General Mills' stellar earnings; Shopify stock sank on a data breach; and there's a joint bid to acquire Cubic Corporation.

The Dow Jones Industrial Average (DJI - 26,763.13) fell 525.1 points, or 1.9%. Nike (NKE) led the list today, topping the list of two winners with an 8.8% rise. Meanwhile, Salesforce.com (CRM) landed at the bottom with a 4.8% drop.

Meanwhile, the S&P 500 Index (SPX - 3,236.92) lost 78.7 points, or 2.4% for the day. The Nasdaq Composite (IXIC - 10,632.99) added 330.7 points, or 3% for today's session.

Lastly, the Cboe Volatility Index (VIX - 28.58) added 1.7 points, or 6.4% for the day.

- In an effort to resolve government investigations into trading practices regarding the metal and Treasuries markets, JPMorgan Chase is reportedly ready to pay nearly $1 billion. (CNBC)

- In order to bolster economic recovery, the U.S. Congress and Federal Reserve both need to "stay with it," according to Fed Chair Jerome Powell. (Yahoo Finance)

- General Mills stock got a boost after a stellar earnings report.

- A data breach sent Shopify stock sliding.

- Two companies are looking to acquire Cubic Corporation in a joint bid.

Data courtesy of Trade-Alert

Gold Slides to Two-Month Low on Dollar's Rally

Oil moved higher on Wednesday, propped up by rising investor risk appetite as well as a report that showed black gold inventories fell; however, rising supply and stalling demand concerns kept a lid on gains. In response, November-dated crude tacked on 13 cents, or 0.3%, to settle at $39.93 per barrel for the day.

Gold prices, meanwhile, slid to a two-month low, as the dollar's rally was extended. Sentiment was bruised further by a lack of additional pandemic-related stimulus. Gold for December-delivery lost $39.20 or 2.1%, to settle at $1,868.40 an ounce for the day.