Treasury Secretary Mnuchin's stimulus comments were not optimistic

The Dow closed lower for the second-straight day, down 165 points after the markets pivoted lower amid soured second stimulus hopes. With sentiment around the subject already dwindling this week, Treasury Secretary Steven Mnuchin today announced that although progress between Democrats and Republicans is being made, he did not expect a stimulus package before the election. The S&P 500 Index and Nasdaq also closed in the red, as investors unpack a slew of less-than-ideal post-earnings reactions from banking giants.

Continue reading for more on today's market, including:

- This software stock could keep rallying.

- AutoZone stock speeds past pressure on lofty bull note.

- Plus, pharma stock sees optimism despite setback; LVGO trailed by sector competition; and the major retailer rising.

The Dow Jones Industrial Average (DJI - 28,514) lost 165.8 points, or 0.6% today. Dow (DOW) led the charge with a 2% win, while UnitedHealth (UNH) landed at the bottom with a 2.9% loss.

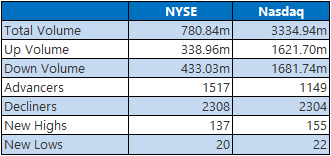

Meanwhile, the S&P 500 Index (SPX - 3,488.67) fell 23.3 points, or 0.7% for the day, while the Nasdaq Composite (IXIC - 11,768.73) shed 95.2 points, or 0.8%.

Lastly, the Cboe Volatility Index (VIX - 26.40) added 0.3 point, or 1.3%.

- Video platform YouTube is one of various social media companies under pressure to control misinformation on its website. Today, it updated this particular policy in regard to false claims. (CNBC)

- The U.S. State Department issued a formal warning to specific international financial institutions that they may face sanctions. (Reuters)

- Eli Lilly's halted antibody treatment didn't deter options bulls.

- Telehealth stock eyes fresh highs despite downgrade.

- Macy's announced a new CFO ahead of the holiday season.

Oil, Gold Finish Higher

Oil futures rose for the second-straight session after news that Russia and Saudi Arabia restated their commitment to the Organization of the Petroleum Exporting Countries (OPEC+) production-cut agreement. November-dated crude rose 84 cents, or 2.1%, to settle at $41.04 a barrel.

Gold futures finished higher today as well, taking back some of yesterday's steep losses. December gold rose $12.70, or 0.7%, to settle at $1,907.30 an ounce.