Vaccine developments weren't enough to help the major indexes

Stocks fell for a second-straight day, taking a breather after the market's recent rally to record highs. The blue-chip index shed nearly 345 points, logging another day of triple digit losses, as investors mulled over the recent vaccine developments and coronavirus cases surged. Meanwhile, the S&P 500 and the tech-heavy Nasdaq Composite finished marginally lower, with the the latter hit particularly hard after Amazon.com (AMZN), Microsoft (MSFT), Alphabet (GOOG), and Facebook (FB) all backpedaled.

Continue reading for more on today's market, including:

- Why this retail powerhouse just hit an all-time high.

- Options are surging for this recliner maker.

- Plus, why options traders are targeting NVDA; two drugmakers give their final vaccine update; and one discount department store stock worth watching.

The Dow Jones Industrial Average (DJI - 29,438.42) lost 344.9 points, or 1.2%. Dow (DOW) topped the list of three winners, after adding 1.5%. Meanwhile, Boeing (BA) fell 3.2% to pace the laggards.

Meanwhile, the S&P 500 Index (SPX - 3,567.79) fell 41.7 points, or 1.2%, for the day. The Nasdaq Composite (IXIC - 11,801.60) shed 97.74 points, or 0.8% for the day. .

Lastly, the Cboe Volatility Index (VIX - 23.84) rose 1.1 point, or 5% for the day.

- Senate Democrats, and a few Republicans, temporarily blocked the Federal Reserve nomination of Judy Shelton. (MarketWatch)

- New York City Mayor Bill de Blasio announced via Twitter today that city schools will move to remote learning only in response to rising COVID-19 cases. (CNBC)

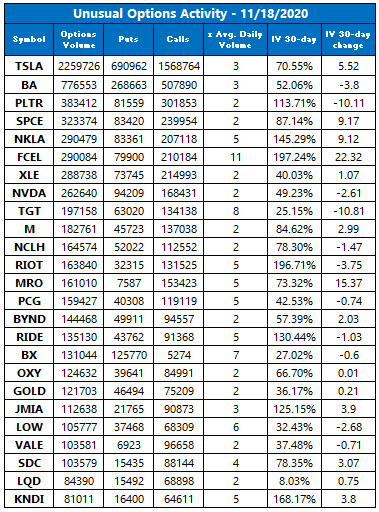

- Why options traders targeted Nividia stock.

- Pfizer and BioNTech calls are hot on final vaccine update

- Why ROST may be a stock worth keeping on your watchlist.

Oil Notches 11-Week High on OPEC+ Delay Hopes

Oil prices rose to their highest level in 11 weeks, amid hopes that the Organization of Petroleum Exporting Countries and its allies (OPEC+) will delay its planned oil output increase. Additionally, Pfizer's announcement regarding the increased efficacy of its COVID-19 vaccine boosted investor sentiment. In response, December-dated crude added 39 cents, or 0.9%, to settle at $41.82 a barrel.

Gold prices, meanwhile, dipped slightly today, as vaccine optimism counteracted concerns over rising infections and bets for additional economic support. As a result, December gold lost $11.20, or 0.6%, to settle at $1,873.90 an ounce for the day.