All three major benchmarks are lower at midday

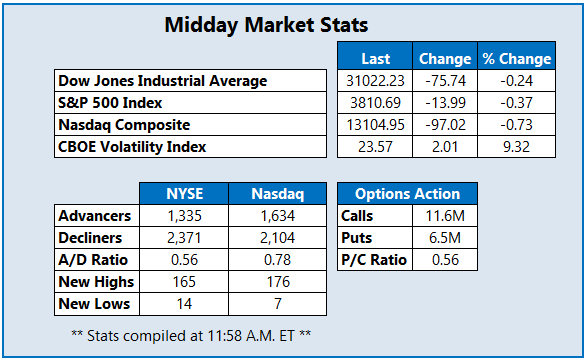

Stocks are lower this afternoon, extending this morning's retreat from record levels, as investors continue to weigh equity valuations, stimulus anticipation, and the aftermath of last week's pro-Trump attack in Washington, D.C. The Dow Jones Industrial Average (DJI) is roughly 75 points lower at midday. Meanwhile, the S&P 500 Index (SPX) and tech-heavy Nasdaq Composite (IXIC) are swimming in red ink, as well. Elsewhere, investors are carefully watching Congress after House Speaker Nancy Pelosi said Democrats would move toward impeaching President Donald Trump again if Vice President Mike Pence fails to invoke the 25th Amendment.

Continue reading for more on today's market, including:

- A J.P. Morgan bull note catapults Tesla rival to record highs.

- Marriott stock in focus after company cuts off several political donations.

- Plus, TWTR options under pressure after Trump ban; retail stock surges on prelim earnings; and InVitae stock plummets on dismal 2021 guidance.

One stock seeing notable options activity today is Twitter Inc (NYSE:TWTR), last seen down 6.6% to trade at $48.12, despite earning a price-target hike from Jefferies to $52 from $46. The social media giant lost nearly $5 billion in market value after permanently suspending President Donald Trump's account following last week's attack on the U.S. Capitol, spurring concerns among investors over the regulation of social networks. So far today, 185,000 calls and 183,000 puts have crossed the tape, which is six times the intraday average. Most popular is the January 2021 50-strike call, followed by the 45-strike put in the same monthly series, with positions being opened at the latter. The security just hit a Dec. 16 six-year high of $56.11, but is now testing support at the 100-day moving average. Year-over-year, TWTR is still up 46.5%.

Near the top of the New York Stock Exchange (NYSE) today is Boot Barn Holdings Inc (NYSE:BOOT), last seen up 12.1% at $54.50, after earlier hitting an all-time-high of $55.64. The major bull gap came after the apparel retailer reported better-than-expected preliminary third-quarter earnings, and a 6% guidance update. As a result, the security earned an upgrade from J.P. Morgan Securities to "overweight" from "neutral," and no fewer than four other analyst lifted their price targets. Boot Barn stock has been getting support from the 40-day moving average since August, and sports a 254.3% nine-month lead.

Near the bottom of the NYSE today is InVitae Corp (NYSE: NVTA), last seen down 10.1% to trade at $45.99. While the firm posted a preliminary fourth-quarter revenue growth of over $278 million, its 2021 guidance missed Wall Street's estimates, likely due to COVID-19 impacts and assumptions surrounding the ArcherDx acquisition. The equity has been cooling off from a Dec. 14 all-time-high of $61.59, and this past month has been quite choppy, though the 120-day moving average has contained most of this volatile price action. Year-over-year, however, NVTA remains up 175.2%.