The benchmark 10-year note yield rose to its highest level since March

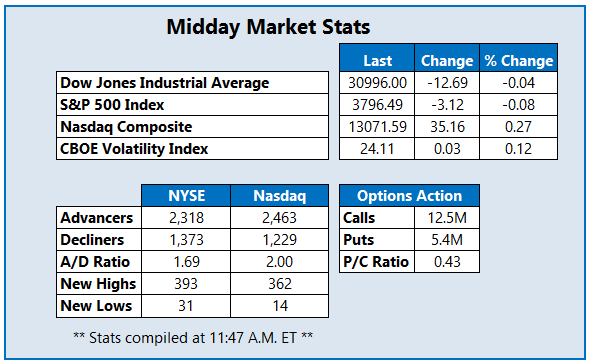

Stocks are struggling for direction this afternoon, as investors reacted to interest rates moving higher. Specifically, the benchmark 10-year note yield rose to its highest level since March, adding 1.2%, while the 30-year bond rate rose nearly 1.9%. Meanwhile, Wall Street is still hanging on to the possibility of further economic relief coming from a Democrat-controlled Congress and White House. And while this is keeping some of these losses in check, investors are concerned equity market valuations may have gone too far. In response, the Dow Jones Industrial Average (DJI) and S&P 500 Index (SPX) are trading just below the breakeven, while the Nasdaq Composite (IXIC) has also plunged into the red, reversing this morning's modest gains.

Continue reading for more on today's market, including:

- Major bank stock rises after cutting business ties with Trump.

- Secondary stock offering sends ZM higher.

- Plus, options bulls blast Ford stock; drilling stock rises after Citigroup bull note; and Postal Realty Trust stock falls on underwritten public offering.

One stock seeing notable options activity today is Ford Motor Company (NYSE:F), last seen up 4.3% to trade at $9.69, after the automaker said it would close its manufacturing operations in Brazil, and take pre-tax charges of about $4.1 billion. The news elicited a price-target hike from J.P. Morgan Securities to $11 from $10. Today's options activity shows that 349,000 calls and 63,000 puts have crossed the tape so far, which is five times the intraday average. Most popular by far is the January 2021 10-strike call, followed by the February 10 call. The security is pacing for its highest close since July 2019, toppling a recent ceiling at the $9.50 mark. In the last nine months, F has added roughly 83%.

Near the top of the New York Stock Exchange (NYSE) today is offshore drilling contractor Transocean LTD (NYSE:RIG), up 14.6% at $3.18 at last check. The bull gap came after the stock received a price-target hike from Citigroup to $3 from $1.30. Shares have struggled on the charts over the past year, dropping to an Oct. 30, all-time-low of 65 cents, after two failed rally attempts in June and August. However, the equity is now getting support from the 30-day moving average, and has tacked on 298.8% in the last three months.

Near the bottom of the NYSE today is Postal Realty Trust Inc (NYSE:PSTL), last seen down 4.5% to trade at $15.40, after pricing its upsized follow-on underwritten public offering of 3.25 million shares of its Class A common stock at $15.25 per share. The security has been trading sideways on the charts for much of the past year, after falling to a March 23 all-time-low of $10.84. Shares are now struggling with overhead pressure at the $17 mark, and longer term Postal Realty Trust stock carries a 7.1% year-over-year deficit.