The Dow tumbled triple digits in response to a Fed decision

Stocks finished the week mixed, with the blue-chip index losing triple digits following the U.S. Federal Reserve's decision to end a pandemic-era capital break rule for banks. The decision sent bond yields surging again -- hovering near their 14-month high above 1.75% -- and led to a sell-off in the financial sector. JPMorgan (JPM), Wells Fargo (WFC), and Bank of America (BAC) in particular lost big, each shedding over 3%, while Goldman Sachs (GS) fell around 1.5%.

As a result, the Dow fell 234 points, the S&P 500 finished relatively flat, and the Nasdaq notched a win. Further, the major indexes all logged weekly losses, with the IXIC locking in a particularly dismal week, as soaring bond yields sent investors scurrying away from high-flying tech stocks.

Continue reading for more on today's market, including:

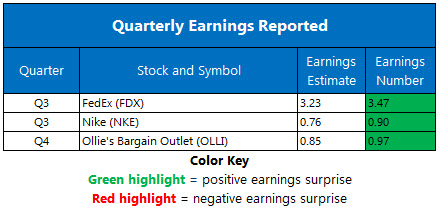

- Bull notes poured in for OLLI after upbeat quarterly report.

- Analyst backs HIG on heels of buyout offer.

- Plus, Vulcan Materials stock's technical setup; more on Nike's revenue miss; and bulls blast FDX after earnings.

The Dow Jones Industrial Average (DJI - 32,627.97) fell 234.3 points, or 0.7% for the day, and 0.5% on the week. Home Depot (HD) topped the list of Dow components with a 2.1% rise, while Visa (V) fell 6.2% to pace the laggards.

Meanwhile, the S&P 500 Index (SPX - 3,886.75) lost 2.4 points, or 0.06% for the day. The Nasdaq Composite (IXIC - 13,215.24) added 99.1 points, or 0.8% for the day. The indexes each lost 0.8% for the week.

Lastly, the Cboe Volatility Index (VIX - 20.95) fell 0.6 point, or 2.9% for the day, but rose 1.3% on the week.

- The Federal Reserve will not extend a pandemic-era rule that deals with the amount of capital banks have to maintain. (CNBC)

- The Federal Trade Commission (FTC) is calling for "bold action" to rein in some of America's largest companies in the tech sector and beyond. (MarketWatch)

- A look at VMC's technical setup after its February peak.

- Nike's revenue miss failed to deter options traders and analysts.

- Bulls responded after FedEx reported an earnings beat.

Gold Nabs Three-Week High

Oil snapped a five-day losing streak to close out the Friday with a win, amid renewed lockdown measures in Europe. Tensions also rose in Saudi Arabia after a crude facility was attacked by drones. In response, May-dated crude added $1.38, or 2.3%, to settle at $61.44 per barrel for the day, but shed 6.4% for the week -- its largest weekly drop since October.

Gold prices rose to a three-week high on Friday, as U.S. Treasury yields remained in focus and the Fed stayed dovish. The precious metal also locked in a second straight weekly win. As a result, April-dated gold tacked on $9.20, or 0.5%, to settle at $1,741.70 an ounce on the day, and up 1.3% for the week.