All three indexes were deep in the red earlier in the day

Despite spending most of the day in the red, the Dow, S&P 500, and Nasdaq all caught a break and ended the session higher, as retreating bond yields helped ease today's pressure. The blue-chip index scored a triple-digit gain, despite being down as much 348 points at its session lows. The Nasdaq eked out a win despite a lackluster outing from the tech sector. Elsewhere, Wall Street's "fear gauge," the Cboe Volatility Index (VIX), roared to its highest level since March 10 before closing in the red.

Continue reading for more on today's market, including:

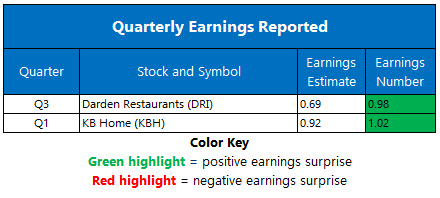

- Options traders played KBH's post-earnings breather.

- This bakery stock could be the right pick for dividend traders.

- Plus, more on VIAC's ugly slide; options bulls feast on DRI; and the fallout from AstraZeneca revised vaccine efficacy rate.

The Dow Jones Industrial Average (DJI - 32,619.48) rose 199.4 points today, or 0.6% for the day. Boeing (BA) topped the long list of Dow winners with a 3.3% rise, while Nike (NKE) fell 3.4% to pace the seven laggards.

Meanwhile, the S&P 500 Index (SPX - 3,909.52) added 20.4 points, or 0.5% for the day. The Nasdaq Composite (IXIC - 12,977.68) gained 15.8 points, or 0.1% for the day.

Lastly, the Cboe Volatility Index (VIX - 19.81) fell 1.4 point, or 6.6%, on the day.

- The CEOs of Facebook, Twitter, and Google addressed Congress once again today, and laid out steps they've taken to combat the spread of misinformation on their respective platforms. (CNBC)

- U.S. President Joe Biden made his first appearance before White House reporters today, taking questions concerning the border, gun control, and Covid-19. (MarketWatch)

- Options traders blasted CBS stock after a massive stock sale.

- Olive Garden's parent is getting a lot of bullish attention.

- A revised vaccine efficacy rate wasn't enough to slow down AZN.

Oil Stumbles Over European Covid-19 Woes

Oil prices fell today, as Covid-19 woes in Europe offset the disruption at the Suez Canal. Tug boats are unable to move the stranded container ship that's blocking crude oil carriers in the canal, but weakening European demand for black gold outweighed the effect the drama would normally have on prices. In response, May-dated crude shed $2.62, or 4.3%, to settle at $58.56 per barrel.

Gold prices logged a loss too, losing as much as they gained a day earlier as investors await a catalyst to pull the precious metal out of its current trading range. April-dated gold lost $8.10, or 0.5%, to settle at $1,725.10 an ounce.