The blue-chip index was down as much as 160 points earlier today

The Dow scored a nearly triple-digit win to kick off the week, despite earlier being down as much as 160 points at its session lows. The blue-chip index managed to secure a third-straight win and shake off big losses from bank names, which suffered in the wake of Hwang's Archegos Capital Management's forced liquidation. The S&P 500 closed relatively flat, while the Nasdaq once again finished in the red as bond yields moved higher. Looking ahead, U.S. President Joe Biden is expected to unveil his infrastructure plan on Wednesday, a plan that could cost close to $3 trillion.

Continue reading for more on today's market, including:

- Amazon.com stock remained steady despite multiple headlines.

- With earnings ahead, Conn's stock should be on traders' radars.

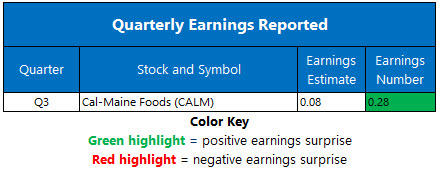

- Plus, Tencent's buyback plan; call traders eyeing TWTR; and more on CALM's mixed earnings report.

The Dow Jones Industrial Average (DJI - 33,171.37) rose 98.5 points today, or 0.3% for the day. Boeing (BA) topped the list of 17 Dow winners with a 2.5% rise, while JPMorgan Chase (JPM) fell 1.6% to pace the laggards.

Meanwhile, the S&P 500 Index (SPX - 3,971.09) lost 3.5 points, or 0.09% for the day. The Nasdaq Composite (IXIC - 13,059.65) fell 79.1 points, or 0.6% for the day.

Lastly, the Cboe Volatility Index (VIX - 20.74) rose 1.9 point, or 10%, today.

- Some landlords are selling their properties following an extension of the federal eviction ban. (CNBC)

- According to White House officials, the president wants to fast-track leasing for wind turbines in federal waters. (MarketWatch)

- Tencent stock stagnated after announcing its new share buyback plan

- Options bulls piled on Twitter stock after an upgrade.

- The U.S.' largest egg producer turned in a mixed earnings report.

Oil Rises Despite Suez Canal Reopening

Oil prices began the week higher. Despite the nearly week-long blockage in the Suez Canal clearing up, fears of continued delays helped black gold bump higher. Elsewhere, investors are looking toward the Organization of the Petroleum Exporting Countries and their allies' (OPEC+) latest decision on future production curbs. In response, May-dated crude added 55 cents, or 1%, to settle at $61.52 per barrel.

Gold prices fell on Monday as well, slipping to a two-week low thanks to a strengthening dollar and rising bond yields. The yellow metal was also dented by bets for a quick economic recovery in the U.S. April-dated gold shed $20.10, or 1.2%, to settle at $1,712.20 an ounce.