The Nasdaq snapped a four-day losing streak

The Dow had another stellar session today, adding more than 318 points to register its second-straight record close on better-than-expected jobless data. Meanwhile, both the S&P 500 and tech-heavy Nasdaq erased earlier losses to finish with modest gains, with the latter also snapping a four-day losing streak in the last hour of trading.

Elsewhere, investors are looking ahead to tomorrow's April's jobs report, which will give Wall Street additional insight into how close the U.S. is to full economic recovery. Investors are also keeping an eye on corporate reports from the likes of Dropbox (DBX), Expedia (EXPE) and Roku (ROKU), which were all released after today's close.

Continue reading for more on today's market, including:

- Don't sweat this semiconductor stock's latest pullback.

- Bull signal says Alcoa stock could keep climbing up the charts.

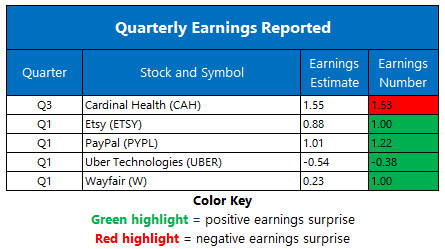

- Plus, unpacking REGN's blowout earnings; beer stock pops on CEO departure; and why analysts had mixed feelings towards UBER.

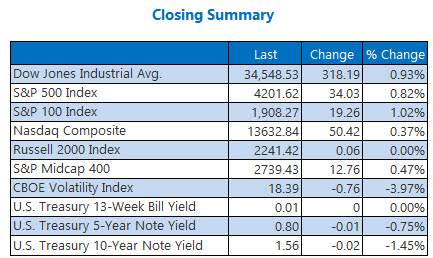

The Dow Jones Industrial Average (DJI - 34,548.53) rose 318.2 points, or 0.9% for the day. Cisco Systems (CSCO) led the Dow components with a 2.6% rise, while Caterpillar (CAT) paced the laggards, falling 0.3%.

Meanwhile, the S&P 500 Index (SPX - 4,201.62) added 34 points, or 0.8% for the day. The Nasdaq Composite (IXIC - 13,632.84) jumped 50.4 points, or 0.4% for the day.

Lastly, the Cboe Volatility Index (VIX - 18.39) fell 0.8 point, or almost 4% for the day.

- Sen. Elizabeth Warren is pushing U.S. President Joe Biden to forgive up to $50,000 per borrower in federal student debt, while the White House reviews his authority to cancel loans. (CNBC)

- Walt Disney (DIS) and Universal Studios owner Comcast (CMSA) will phase out temperature screenings at their Florida theme parks for both employees and visitors this month. (MarketWatch)

- Regeneron stock redeemed itself after an impressive earnings report.

- Beer name moves higher on news of chief executive's departure.

- Higher driver costs weigh on UBER despite quarterly win.

Gold Prices Notch Highest Close Since February

Oil prices were lower on Thursday for a second-straight session, on the heels of dismal U.S. gasoline usage data. Plus, traders were growing increasingly worried regarding the number of coronavirus cases in India. In turn, June-dated crude fell 92 cents, or 1.4%, to settle $64.71per barrel.

Gold prices surged, on the other hand, notching their highest close since February to settle above the significant $1,800 level. Boosting the yellow metal was weakness in the U.S. dollar, as well as reassurance from the Federal Reserve that interest rates will stay low. As response, June-dated gold added $31.40, or 1.8%, to settle at $1,815.70 an ounce.