The Dow closed 286 points higher

The Dow closed 286 points higher today, erasing Monday's sell-off as reopening stocks continue to climb, while the S&P 500 and Nasdaq finished the day in the black as well. The 10-year Treasury yield continued to erase some of the losses it suffered earlier in the week, with many considering Monday's negative reaction to the Covid-19 delta variant on the global economy too extreme. A slew of upbeat earnings reports boosted sentiment, with several blue-chip names seeing strong results.

Continue reading for more on today's market, including:

- Blue-chip pop stock hit annual highs after earnings.

- The video game giant bulls should target.

- Plus, a look at ZEUS; bull notes galore for CMG; and JNJ's beat-and-raise.

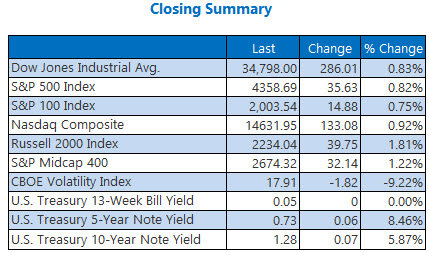

The Dow Jones Average (DJI - 34,798.00) rose 286 points, or 0.8%. Of the 30 Dow components, Chevron (CVX) was at the top of the list today, adding 3.5%, while Amgen (AMGN) landed at the bottom of the list with an 0.8% drop.

Meanwhile, the S&P 500 Index (SPX - 4,358.69) gained 35.6 points, or 0.8%, and the Nasdaq Composite (IXIC - 14,631.95) tacked on 133.1 points, or 0.9%.

Lastly, the Cboe Volatility Index (VIX - 17.93) lost 1.8 points, or 9.2% for the day.

- Aside from today's earnings beat, detailed below, Johnson & Johnson will stop selling opioids for 10 years as part of its billion-dollar settlement. (Marketwatch)

- Cryptocurrency Ethereum is on the rise after Elon Musk confirmed that he owns it. (CNBC)

- A look at Olympic Steel stock's risk/reward ratio.

- Analysts crowd CMG amid fresh record highs.

- Behind Johnson & Johnson stock's post-earnings move lower.

Gold Dips Below Significant Level

Oil prices rose for the second-straight day, amid reports of a surprise weekly rise in U.S. crude supplies by 2.1 million barrels. The report also noted a 1.4 million barrel decline at the storage hub in Cushing, Oklahoma, marking the hub's lowest stock since January 2020. The new front-month contract, September-dated crude, rose $3.10, or 4.6%, to settle at $70.30 a barrel.

Gold futures fell lower today, briefly dipping below the psychologically significant $1,800 level mid-session. The rise in U.S. Treasury yields put some weight on the precious metal, though some think the recent global surge in Covid-19 cases could have investors turning back to the safe haven. August-dated gold fell $8, or 0.4%, to settle at $1,803.40 an ounce.