All three major benchmarks are eyeing a dip into the red

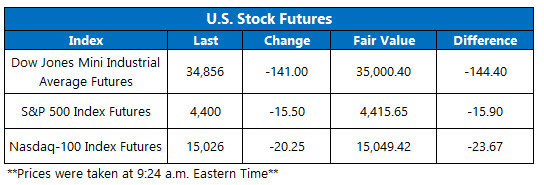

Stock futures are pointed lower this morning, brushing off yesterday's wins as dismal earnings reports from major automakers such as General Motors (GM) weigh on investor sentiment. Futures on the Dow Jones Industrial Average (DJI) are eyeing a 141-point drop, while S&P 500 Index (SPX) and Nasdaq-100 Index (NDX) futures are also in the red. Also contributing to pessimism is the ADP private payroll survey, which showed a smaller-than-expected gain of 330,000 jobs in July. Elsewhere, the 10-year Treasury Yield receded to 1.15%.

Continue reading for more on today's market, including:

- Schaeffer's Senior Quantitative Analyst Rocky White dives into the state of investor sentiment.

- These 25 stocks are some of the worst August performers.

- Plus, LYV pops on surging event sales; behind Avis Budget's best quarter ever; and CVS Health raises minimum wage.

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 1.7 million call contracts traded on Tuesday, compared to 797,901 put contracts. The single-session equity put/call ratio fell to 0.47 and the 21-day moving average stayed at 0.52.

- The shares of Live Nation Entertainment, Inc. (NYSE:LYV) are up 5.1% in premarket trading, after the company said sales for its latest quarter had surged eight times over. The positive results were attributed to a return to events and concerts following Covid-19 vaccinations, with tickets selling out despite a 10% premium from pre-pandemic prices. Year-over-year, LYV has added 67.8%, despite facing volatility.

- Car rental name Avis Budget Group Inc. (NASDAQ:CAR) was last seen up 0.7% ahead of the open. The company earlier reported blowout second-quarter earnings of $5.90 per share, as well as a revenue beat. A surge in demand and higher prices tripled sales, leading the firm to call this its best quarter ever recorded. The equity has charging higher since bouncing off the $66 level, and sports a 253.9% year-over-year lead.

- CVS Health Corp (NYSE:CVS) is 0.9% lower before the bell, despite posting second-quarter profits and revenue that beat Wall Street's estimates. The retail name said same-store sales rose a better-than-anticipated 12.3%, and added it is raising the minimum wage for its employees to $15 per hour. The security has been cooling off from a May 24, five-year high of $90.61, but has added 41.3% in the past nine months.

- Today brings the final Markit services PMI reading, and the ISM services index.

Asian Markets Pop on Upbeat Services Activity Data

Stocks in Asia closed Wednesday’s session with a win, boosted by data that showed Chinese services activity growth accelerated in July. Specifically, the Caixin/Markit services Purchasing Managers’ Index (PMI) finished at 54.9 last month, well above June’s reading and indicating a positive month-over-month expansion. The Kospi in South Korea walked away with the biggest gain, adding 1.3%. Meanwhile, China’s Shanghai Composite and Hong Kong’s Hang Seng each tacked on 0.9%. Rounding out the region, the Japanese Nikkei turned in a 0.2% loss as an uptick in Delta variant infections kept optimism in check.

European markets are also headed for a sunny day, as strong corporate earnings stateside help boost global sentiment. In addition, euro zone business activity is surging, with final PMI readings flashing the fastest expansion the region’s experienced in 15 years. In response, the German DAX is up 0.6%, while London's FTSE 100 and France’s CAC 40 are each 0.3% higher.