The 10-Year Treasury yield is back on the rise

The S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are on the rise midday, extending yesterday's record closes and nabbing fresh intraday highs. The Dow Jones Industrial Average (DJI), meanwhile, is more firmly in the black, as investors gain optimism on signs that the Covid-19 delta variant could be peaking. Meanwhile, the 10-year Treasury yield earlier climbed back above 1.3% to trade at two-week highs, after economic data showed U.S. durable goods orders fell 0.1% in July, narrower than the expected 0.5%.

Continue reading for more on today's market, including:

- Urban Outfitters stock is tumbling after earnings.

- Options bulls eye Johnson & Johnson stock after a vaccine update.

- Plus, DKS options surge amid record highs; SCSC jumps after an upbeat report; and SAVA plummets on allegations.

Retail stock Dick's Sporting Goods (NYSE:DKS) is seeing a surge in options activity today, as it soars to record highs following the company's upbeat second-quarter report and forecast. So far, 50,000 calls and 27,000 puts have crossed the tape, 34 times the typical volume seen at this point. The weekly 8/27 135-strike call is the most popular by far, with new positions being opened there. At last check, DKS was up 14.2% to trade at $130.66.

Meanwhile, Scansource Inc (NASDAQ:SCSC) stock is surging today, up 17.3% to trade at $35.99 at last check, after the company's fiscal fourth-quarter earnings beat. Plus, Raymond James raised its price target to $40 from $35. The shares are now trading at fresh annual highs, up 37.5% year-to-date.

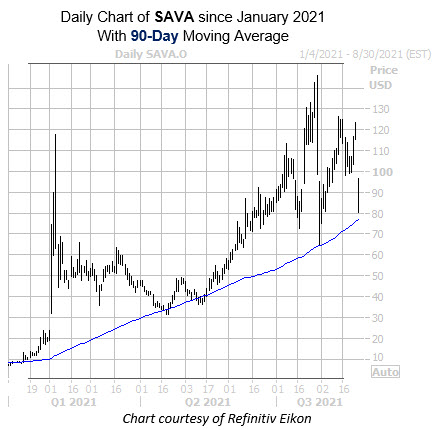

Conversely, Cassava Sciences Inc (NASDAQ:SAVA) is plummeting, down 22.3% to trade at $91.53 at last check. Weighing on the stock this morning are allegations concerning the company's Alzheimer's drug, after a Citizen Petition was filed with U.S. Federal Drug Administration (FDA). Still, the stock has staged a wild rally since the start of the year, and the 90-day moving average recent caught SAVA's pullback to the $65 level.