The Dow is down 290 points midday

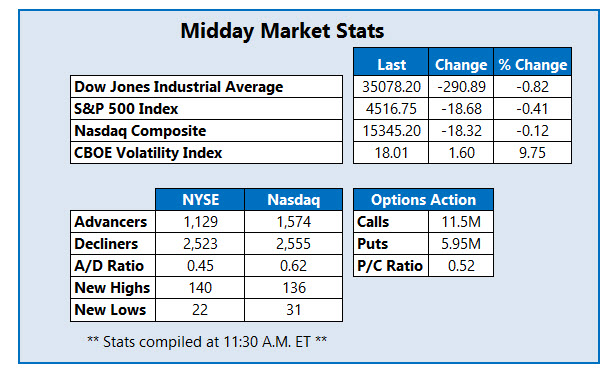

The Dow Jones Industrial Index (DJI) is kicking off the holiday shortened week on a sour note, down roughly 290 points this afternoon, as anxieties surrounding the Covid-19 delta variant and its effects on the economy begin to creep back in. The S&P 500 (SPX) and tech-heavy Nasdaq Composite (IXIC) are following suit. Sentiment elsewhere is souring, with Goldman Sachs downgrading its economic forecast, and Morgan Stanley slashing its rating on U.S. equities to "underweight." The latter brokerage firm also chimed in with bear notes for several drug stocks, causing the entire sector to sink on Tuesday.

Continue reading for more on today's market, including:

Clover Health Investments Corp (NASDAQ:CLOV) is seeing a surge in bullish options activity today. So far, 238,000 calls and 33,000 puts have exchanged hands, which is quadruple the intraday average. The most popular position is the weekly 9/10 10-strike call, followed by the 9.50-strike call in the same series, with positions being opened at both. CLOV was last seen up 9.4% at $9.67, as investors ready themselves for a short squeeze, while the name regains popularity on speculative trading message boards. Notoriously volatile, Clover Health stock is down 42.2% for the year.

One of the best performing stocks on the New York Stock Exchange (NYSE) today is IronNet, Inc. (NYSE:IRNT), which was last seen up 61.7% at $26.94. IRNT is now up 169.4% this year, and has also captured Reddit's interest today, taking the place of fourth most popular stock StockTwits, and becoming the third most-traded stock across the exchanges. IRNT is trading at its highest level on record. The stock has made big moves over the past couple weeks, surging with support of its 10-day moving average.

CorMedix Inc. (NASDAQ:CRMD) is one of the worst performing equities on the Nasdaq this afternoon, last seen down 24.2% at $4.90, and pacing for its lowest close in almost a year. The company is facing delays with a third-party contract manufacturer (CMO), and though the CMO said these delays are unrelated to CorMedix's DefenCath antimicrobial solution, the timeline to address these deficiencies remains uncertain. CRMD is now down 33.8% for the year, pressured lower by its 60-day moving average.