All three major benchmarks are higher ahead of the bell

Dow Jones Industrial Average (DJI) futures are up 80 points at last check, while futures on the Nasdaq-100 Index (NDX) and S&P 500 Index (SPX) are rising as well, with all three benchmarks looking to add further gains to their back-to-back wins. Core inflation rose 4.7% in November to its highest level since 1982, while durable goods rose 2.5%. Meanwhile, initial weekly jobless claims for last week came in at 205,000 -- just below estimates of 206,000.

Continue reading for more on today's market, including:

- CEO Alexej Pikovsky discusses the future of the cannabis sector.

- Behind WSM's upgrade from Loop Capital.

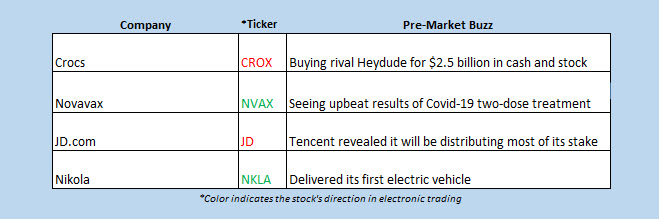

- Plus, CROX's new acquisition; JD stake news; and NKLA's first delivery.

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 1.5 million call contracts traded on Wednesday, and 732,887 put contracts. The single-session equity put/call ratio fell to 0.47, and the 21-day moving average stayed at 0.49.

-

Crocs Inc (NASDAQ:CROX) is buying footwear brand Heydude for $2.5 billion in a cash and stock deal. The deal is expected to close in the first quarter of 2022, after which Heydude will remain a standalone division. CROX is down 0.6% pre-market.

- China-based JD.com Inc (NASDAQ:JD) is down 6.9% in electronic trading, after news that Tencent is reducing its stake to 2.3% from roughly 17%, amid the recent local crack-down on tech. Year-to-date, JD is down 16.1% coming into today.

- Nikola Corp (NASDAQ:NKLA) is up 4.9% before the bell, after the company completed its first electric vehicle delivery. Down 38.4% year-to-date, familiar support at the $9 level has provided a floor for the stock's recent slump.

-

Stocks Rise in Europe, Asia

Asian markets rose on Thursday, as investors across the globe continued to assess the risks of the Covid-19 omicron variant, amid news that the Chinese city of Xi’an has entered lockdown as of today. Meanwhile, Hong Kong investors monitored Tencent’s announcement that it will distribute most of its shares of fellow tech giant JD.com to its shareholders, with the shares valued at approximately 127.7 billion Hong Kong dollars, or $16.37 billion. Tencent added more than 4%, while JD.com suffered a 7% drop. In response, the region’s Hang Seng added 0.4%. Elsewhere, China’s Shanghai Composite saw a 0.6% rise, the South Korean Kospi tacked on 0.5%, and the Nikkei in Japan brought home a 0.8% win.

European stocks are also on the rise as the bourses brush off lockdown threats in favor of a study out of South Africa showing reduced severity in the omicron strain compared to the delta variant. Meanwhile, the U.S. Centers for Disease Control and Prevention’s (CDC) authorization of Pfizer’s (PFE) antiviral Covid-19 pill in patients 12 or older is also bolstering sentiment. At last check, the London FTSE 100 is up 0.1%, the German DAX is 0.6% higher, and the French CAC 40 has risen 0.4%.