U.S. markets were all over the place on Thursday. All three indexes climbed higher midday, as the Nasdaq clawed its way out of correction territory, though the index -- along with the S&P 500 -- both broke back below breakeven during the session's final moments. The Dow, meanwhile, looked like it could hold on to its triple-digit gains, but ultimately joined the other two indexes with a steep loss.

Investors started rotating back into the battered tech sector, which helped puff up markets, though an alarming spike in jobless claims weighed on sentiment, sending a signal that the Covid-19 omicron surge might have a more detrimental effect on the economy than previously thought.

Continue reading for more on today's market, including:

- Could this video game name be Microsoft's next target?

- The chip stock primed for fresh record highs.

- Plus, a major FAANG earnings report; what's going on with Dollar Tree stock; and one bank stock's post-earnings plummet.

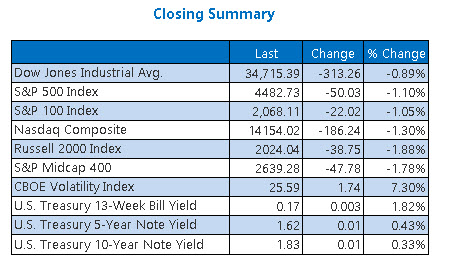

The Dow Jones Average (DJI - 34,715.39) shed 313.3 points, or 0.9% for the day. Travelers Companies (TRV) led the gainers today, adding 3.2%, and Dow Inc (DOW) paced the laggards with a 3.4% fall.

The S&P 500 Index (SPX - 4,482.73) moved 50 points lower, or 1.1%, while the Nasdaq Composite (IXIC - 14,154.02) dropped 186.2 points, or 1.3%, for today's session.

Lastly, the CBOE Volatility Index (VIX - 25.59) added 1.7 point, or 7.3% for the day.

- The Senate Judiciary Committee just voted 16-6 in favor of advancing a major tech antitrust bill called the American Innovation and Choice Online Act, which many believe could be the key to advancing substantial reform into law. (CNBC)

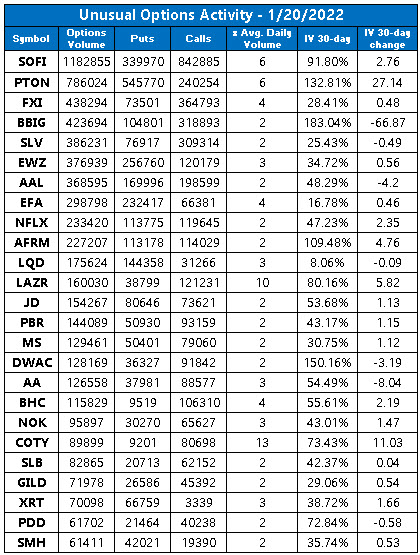

- Peloton Interactive (PTON) is back in headlines today after announcing it would temporarily pause the production of its fitness products due to slowing demand. (MarketWatch)

- A closer look at Netflix stock ahead of this evening's earnings report.

- Is Dollar Tree stock a buy or a sell?

- Another bank stock steps into the earnings confessional.

Unexpected Rise in Crude Inventories Weighs on Expiring February Oil Contract

An unexpected rise in U.S. crude inventories put pressure on on oil prices today, though some of these losses were kept in check by rumors that Russia could potentially invade Ukraine. The February-dated oil contract, which expires today, lost six cents, or a little under 0.1%, to finish at $86.90 for the day.

Gold also fell slightly on Wednesday, falling from yesterday's highest close in two months. February-dated gold tacked lost 60 cents, or 0.1%, to close at $1,842.60 per ounce.