The S&P 500 is also confidently higher

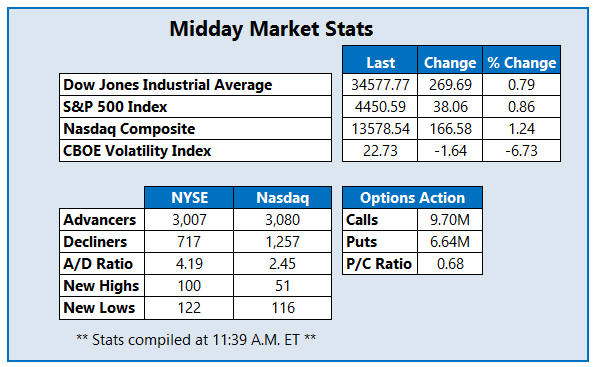

Despite a slightly hotter-than-expected March consumer price index (CPI) reading earlier today, stocks are moving higher, as Wall Street bets on inflation's peak. At last check, the Dow Jones Industrial Average (DJI) is 270 points higher. Meanwhile, the Nasdaq Composite (IXIC) also sports a triple-digit lead, as investors move back toward tech, and the S&P 500 Index (SPX) sits comfortably in the black as well. Elsewhere, the 10-year Treasury yield is pulling back from yesterday's three-year high.

Continue reading for more on today's market, including:

- Analyst says Cisco stock could lose some of its market share.

- Bitcoin-linked MicroStrategy stock is eyeing a comeback.

- Plus, options bulls bombard USFD; Calix stock earns bull note; and MYOV sinks on FDA update.

One stock seeing unusual call volume this afternoon is US Foods Holding Corp (NYSE:USFD). At last check, more than 16,000 calls have crossed the tape -- 18 times the intraday average -- versus 181 puts. The July 40 and 50 calls are by far the most popular, with new positions being bought to open at both contracts. US Foods stock was last seen up 4.1% to trade at $37.52, after the activist investor Sachem Head cut the company's director nominee number to five from seven, while also backing out of plans to take over the board itself. USFD's has seen some volatility on the charts, dipping all the way down to the $30 level in March. The stock's most recent pullback found support at the 200-day moving average, though, and the equity is now up 7.8% in 2022.

One of the best performers on the New York Stock Exchange (NYSE) so far today is Calix Inc (NYSE:CALX). The equity was last seen up 7% to trade at $40.30, after Rosenblatt Securities initiated coverage with a "buy" rating and a $60 price target. CALX is steadily moving toward reclaiming its year-over-year breakeven level, though it sits nearly 50% lower in 2022, after falling from its December record high of $80.95.

Myovant Sciences Ltd (NYSE:MYOV), which was last seen down 24.1% at $10.53. is the worst performing stock on the NYSE at this point today. This drop came after receiving a notice of deficiency for its supplemental New Drug Application with Pfizer (PFE) from the U.S. Food and Drug Administration (FDA). Myovant Sciences stock fell to two-year lows as result, and is now down 36.6% in the last 12 months.