Walmart's profit warning is weighing on the retail sector

The major indexes are falling lower midday, with the Dow Jones Industrial Average (DJI) and Nasdaq Composite (IXIC) both down triple digits as Walmart's (WMT) profit warning haunts the retail sector. The Federal Reserve kicks off its two-day policy meeting this afternoon, drawing Wall Street's focus alongside upcoming Big Tech earnings. In the meantime, economic data showed the consumer confidence index sliding for the third-straight month in June, while the S&P Case-Shiller national home price index rose 1.3% in May -- slower than April's 1.7% gain.

Continue reading for more on today's market, including:

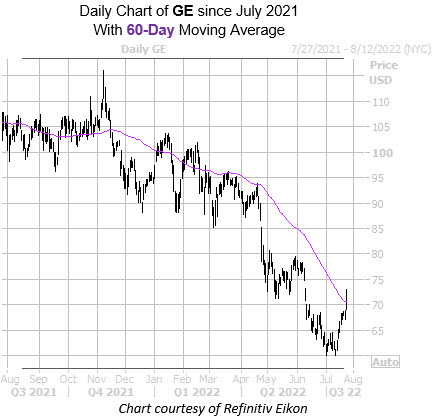

Options traders are targeting General Electric Co (NYSE:GE) after the company's strong second-quarter results. So far, 21,000 calls and 20,000 puts have been exchanged, with overall options volume running at six times the intraday average. The September 65 put is the most popular, followed by the weekly 7/29 72-strike call, with new positions being bought to open at both. At last glance, GE was up 5.6% at $72.20, and jumping above long-term pressure at the 60-day moving average.

One of the best performing stocks on the Nasdaq today is Covenant Logistics Group Inc (NASDAQ:CVLG), up 15.5% at $33.76, after the company's second-quarter results. The truckload shipping name reported profits of $1.63 per share on revenue of $317.38 million, handily beating estimates of $1.31 per share on $282.6 million. Today's pop has the stock breaking out of recent pressure at the $30 level to trade at its highest levels since October 2021.

Meanwhile, the New York Stock Exchange's (NYSE) Shopify Inc (NYSE:SHOP) is slipping 16.5% to trade at $30.57 as Walmart's profit warning weighs. Plus, the e-commerce company is cutting 10% of its workforce amid a slowdown in consumer spending. The security has been middling between the $30 and $40 levels for the past couple months, and the $30 level is providing a floor for today's pullback.